Introduction

In April 2011, Wikibon conducted a survey with 361 users who were using vSphere, mainly v3 or v4. In July 2012 Wikibon mounted another Web-based survey aimed at the same population but focusing on those who had vSphere experience. Wikibon used the same method of attracting participation for both surveys – using Wikibon members and asking the vendors that Wikibon has been working with on the Integration Analysis to socialize the survey through their channels.

The survey questions in the 2012 version are shown in Table 1 in the footnotes below. Many of the questions were very similar to those in the 2011 survey, so that we could analyze trends between the two years. The 2012 sample was smaller than the 2011 version, with 212 initial respondents and 158 valid responses after cleaning and eliminating vendor entries. As in 2011, there was a very high quality of respondent competence shown by extensive entries to open-ended questions.

This posting is one of several that look at different aspects of our results. In this post we will focus on customer satisfaction and adoption of vSphere 5, and the changes in Mindshare that occurred since the prior survey.

Satisfaction & Adoption

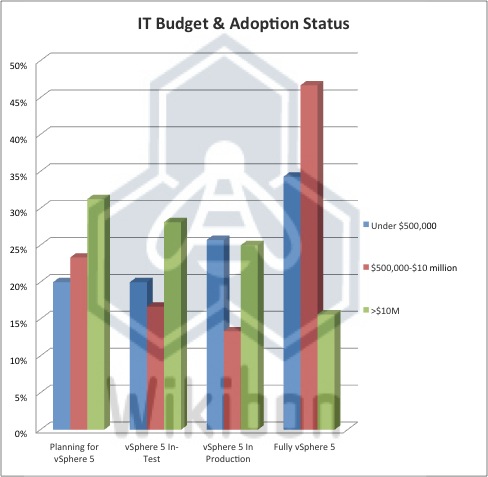

Figure 1 below shows a breakout of the adoption survey by IT budget size. Predictably the larger users were planning migrations, but were taking longer to move production to vSphere 5. For the smaller organization, however, the opposite was true.

Source: Wikibon 2012, from Survey July 2012, n=156

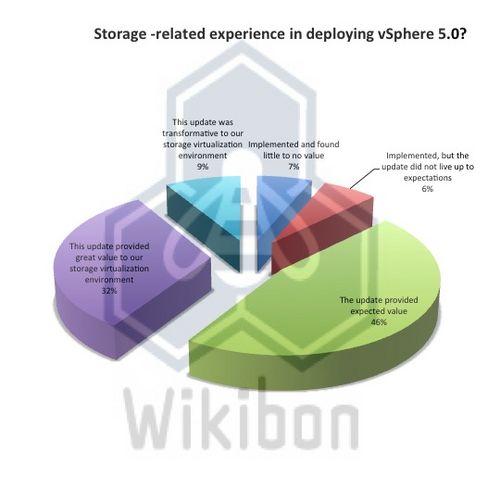

On the satisfaction side, Wikibon was focusing on storage integration issues, so a key question concerned their “storage -related experience in deploying vSphere 5.0”. The responses, together with the seven in-depth interviews we conducted, showed a high level of satisfaction for a product that had been in GA for nine months. Only 13% reported a negative experience.

Source: Wikibon 2012, from Survey July 2012, n=125

Vendor Mindshare

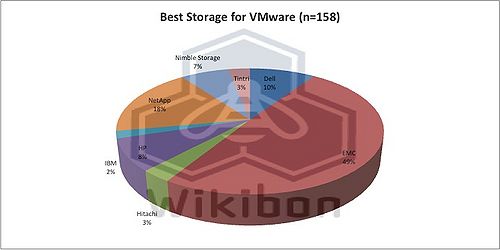

The chart in Figure 3 should be a source of satisfaction for EMC but also a source of concern to VMware. Some 49% of the respondents indicated that EMC was their primary vendor. However, 10% of the sample rated the hybrid solutions (Nimble & Tintrí) as the “best”. This was higher that every vendor (Dell, IBM Hitachi, HP) except EMC & NetApp. This should be a wakeup call to VMware that EMC and the stale cartel of traditional vendors who have been invited to work on the new vision are not providing the new thinking and fresh approaches that the market wants.

Source: Wikibon 2012, from Survey July 2012, n=158

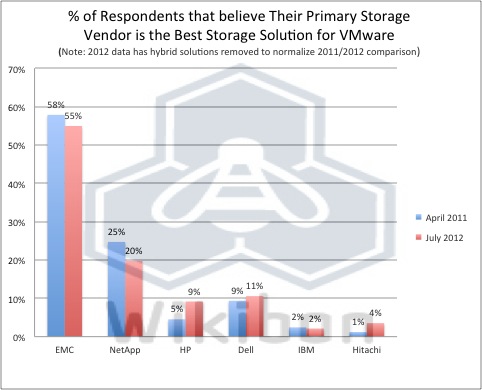

In the following charts the reason for the high EMC number becomes clear. In Figure 4 below, the 2011 data is compared with the 2012 data for the subset of respondents who had rated their incumbent vendor as the best storage solution for VMware. This shows that there is still strong but slightly declining support for the leading incumbent vendors.

Source: Wikibon 2012, from Survey July 2012

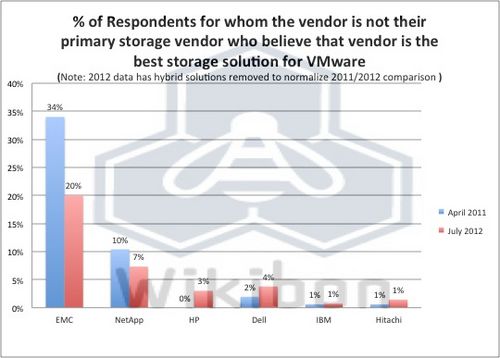

However, Figure 5 below shows the rating of vendors outside their installed base, and this shows a sharp decline from 2011. This shows a significant drop in confidence in all other vendors vs. their existing vendor. Given the very high percentage of EMC (47%) and NetApp (16%) shops, there is strong cause for concern in the reduction in mindshare outside their base. It is not surprising that EMC and NetApp would be chosen for a leading/bleeding edge installation of vSphere 5. However, outside their base, the mindshare of the hybrids is 10%, greater that NetApps 7%, and half of EMCs 20%.

Source: Wikibon 2012, from Survey July 2012, n=158

Conclusions

The survey has good news for VMware. Adoption among this sample is high, and satisfaction is equally high. The traditional VMware storage vendors have implemented a significant number of the APIs. However, the majority of recommendations for additional function focused on storage issues. The sample shows strong adoption of VMware but a reluctance to move latency sensitive databases to VMware. The main reason for non-virtualization is performance concerns with storage latency and response time. New thinking is required to address this, and VMware should cast a broader net for new ideas beyond the traditional storage vendors.

Additional Survey Results

Additional articles examining the responses:

- User feedback on vSphere 5 and overall virtualization adoption

- Storage Protocol analysis

- Multiple hypervisor deployments

Action Item: Executives responsible for VMware who are looking for specific functions available in vSphere 5 (either storage or VDI features) should be encouraged by the positive implementation experiences of the sample and should be able to plan migrations with a high probability of success. However, vSphere 5 improves but is not a long-term solution to the endemic storage problems of VMware. Executives should be pushing VMware hard to innovate and come up with better storage frameworks.