Executive Summary

Virtualization has moved beyond an approach to consolidate physical server sprawl, with a narrow focus on test and development workloads, to much more of a strategic platform for business value creation. Abstracting infrastructure complexity, hardening availability and more integration across the stack has enabled organizations to connect deeper into business processes as they begin to aggressively support business and mission critical applications. Generally, the overheads associated with virtualization have become minimal and are far outweighed in many workloads by other business benefits.

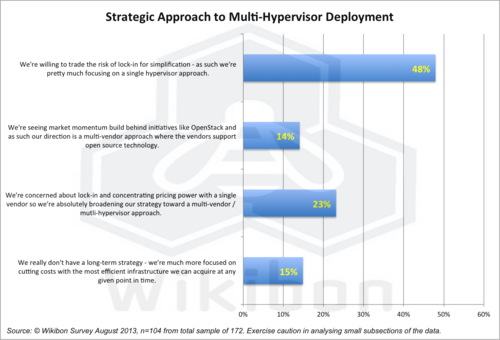

While VMware remains, by far, the dominant platform for virtualizing applications, momentum is building around alternative hypervisors. However the market is bifurcated with a substantial portion of customers opting for a single vendor strategy that is willing to accept the risk of lock-in to obtain higher functionality and greater simplicity. Conversely, a somewhat smaller but still substantial set of customers are looking toward multi-hypervisor approaches that allow them to hedge their sourcing bets. On balance the vendor community is responding to customer demand for both function and diversity by continuing to invest in deep integrations, while at the same time playing the “open” card (i.e. supporting multi-hypervisor functionality and in many cases adopting open source strategies).

The bottom line is customers are demanding: 1) Deeper vertical integration within stacks to more fully automate and cut management and IT labor costs; and 2) support for a wider array of virtualization and management technologies where different workloads will run on different platforms.

Introduction

Many in the Wikibon community have requested analysis of the growing multi-hypervisor environment and advice on which hypervisors are being and should be deployed for different workload environments. To answer those questions and understand what is actually happening in the market, Wikibon has completed a survey of community members on their practices, present use of hypervisors, and plans for the next 18 months.

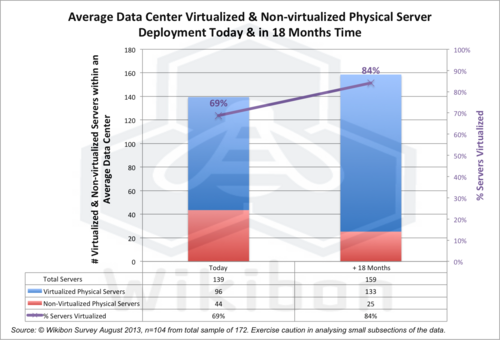

The main conclusions from the survey are that server virtualization is not hitting a wall and is continuing to grow from 69% of servers virtualized today to an expected 84% in eighteen months time. Wikibon also found that the experimentation phase of multi-hypervisor is coming to an end, and consolidation of the number of hypervisors is expected over the next few years. When asked about their strategy (see Figure 1), 48% of the sample said they were willing to trade the risk of lock-in for simplification and expect to focus on a single hypervisor approach.

The survey showed that VMware is dominant, both in market share (76%) and functionality. The Wikibon survey found that all workload types were now being run on VMware.

Microsoft Hyper-V is second in the marketplace survey with 14% share. The perception of many smaller installations with mainly Microsoft business software is that Hyper-V is now “good-enough” and that the Windows 2012 System Management functionality has seen major improvements in functionality.

There is a specific fast-growing niche for KVM in Cloud Service Providers, ISVs and cloud platforms such as OpenStack. It has strong support from hyperscale users such as Google.

OVM is a small and fast growing niche for large Oracle implementations.

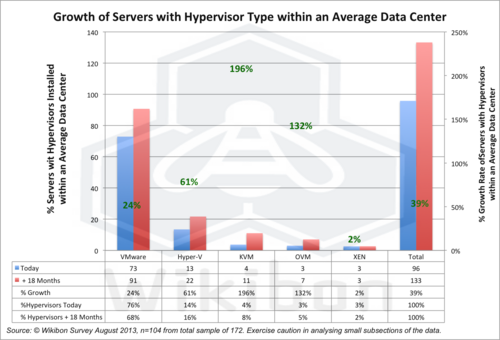

The survey indicates that the overall growth in the virtualization hypervisor market is 39% over the next eighteen months. The expected growth of VMware is lower at 24%. The growth of the combined other hypervisors is 86% over the same time period. The multi-hypervisor section below provides a deeper dive into the results of the survey.

Source: Wikibon 2013

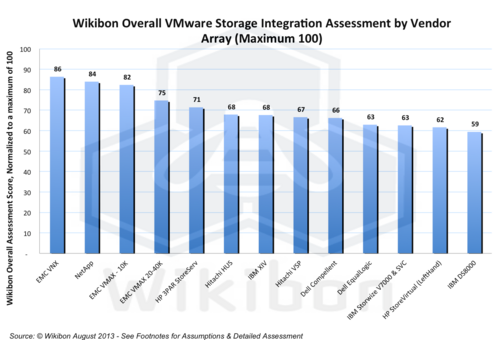

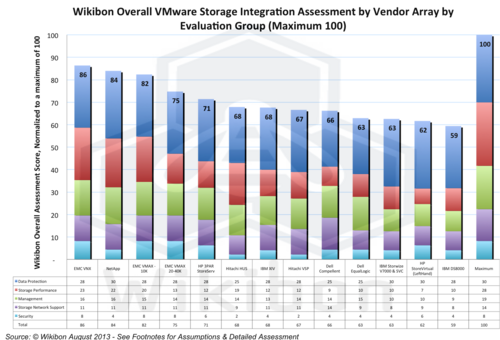

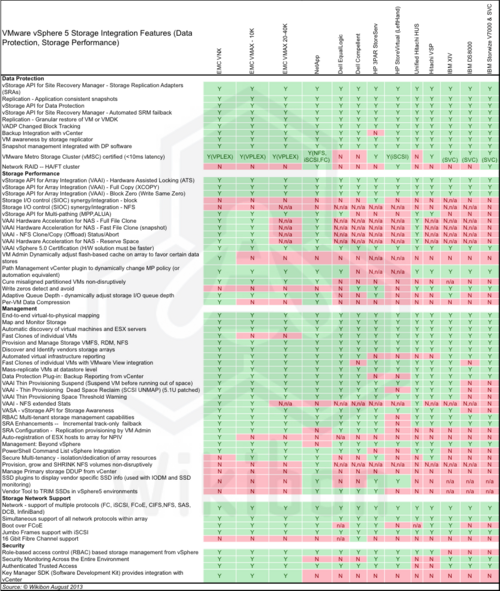

Wikibon also updated its storage integration analysis of the dominant hypervisor vendor, VMware. EMC VNX had the most integration in all categories. EMC VMAX and NetApp are close together and a little lower in integration. Figure 2 shows the overall VMware storage integration assessment by array. Additional analysis is given in the Multi-Hypervisor Survey Analysis section below.

Source: Wikibon October 2013 Update

Wikibon expects VMware to deliver significant new functionality to improve storage function and performance, including vVOLs (at last?!), vFlash and vSAN. Many hybrid and flash-only vendors will use this inflection point to add storage integration functionality. Wikibon expects significant inter-hypervisor support to be added to storage arrays and software-led storage platforms to enable movement of workloads between hypervisors and between physical and virtual.

Wikibon’s advice to practitioners is to stay within the strategic fit envelope of each hypervisor, but to take advantage of workloads on lower cost hypervisors that are appropriate to save budget.

Multi-Hypervisor Survey Analysis

Source: Wikibon 2013

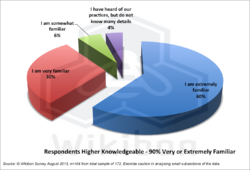

Wikibon ran a Web-based survey of Wikibon community members during August 2013. The level of expertise of the respondents was very high. Figure 3 shows that 90% defined themselves as very or extremely knowledgeable about virtualization in their IT operations. Their level of expertise was also shown in the quality of the open-format comments when we asked for advice to their peers.

There were 172 respondents to the survey. This was reduced to 104 after respondents that completed too little of the survey and respondents who had too many “don’t know” answers were excluded.

An analysis of this sample (n=104) in Figure 4 show the average number of servers installed to be 139, of which 96 (69%) were virtualized. The respondents project that in 18 months time, the number of servers would grow by 14% to 159, and percentage of the servers virtualized would grow to 84% of all 133 servers. Wikibon’s interpretation of this finding is that the direction of virtualization was correct, and the level of vitalization reasonable; Wikibon would expect that the time taken to achieve 84% would be longer than 18 months, more in the order of 30-36 months.

Source: Wikibon 2013

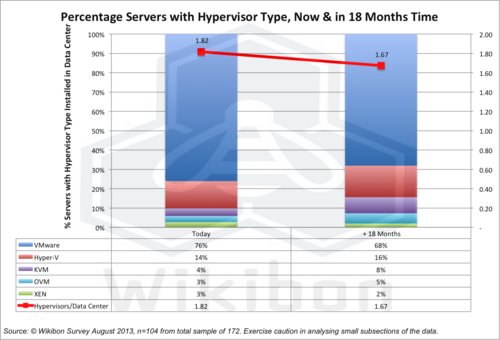

Figure 5 shows the distribution of different hypervisors within the “average” data center represented by the sample. VMware is dominant, with 76% of deployments, and Microsoft second with 14%.

An interesting and telling statistic is the average number of hypervisors deployed per data center. Today there are 1.82 hypervisors per data center. In the sample some had five hypervisors, and some had one (a few had zero). The number of hypervisors projected by the respondents to be present in their data center 18 months out is reduced to 1.67. This is in line with conversations held with practitioners, that there is currently a degree of experimentation going on with different hypervisors, and this experimentation would reduce as IT executives consolidate the number of hypervisors.

Source: Wikibon 2013

Figure 6 shows the growth of hypervisors. Overall the growth rate over 18 months is projected to be 39%. The growth rate of the different hypervisors varies widely. The growth of VMware was projected to be 24%, significantly lower that the overall growth. The growth of Microsoft Hyper-V is 61%, on a smaller base. The growth of KVM was 196% on a very small base, with most of the growth coming from outside of Enterprise IT (VARs, Cloud service providers, etc.) The growth of OVM was 132% on a very small base; a few larger customers drove this growth. The installed base and growth of Citrix Xen was very small in this sample. Another trend within the survey that supports this observation was that the most dominant workload virtualized under Hyper-V was desktop virtualization. This represents Hyper-V as the natural place for VDI implementations from Microsoft and Citrix, with licensing and Microsoft Office 365 services being significant drivers.

Source: Wikibon 2013

More analysis of the hypervisor data is provided in Wikibon Hypervisor Study: Additional Analysis of Multi-Hypervisor Environments

The Wikibon conclusions from this survey are:

- Overall growth of x86 virtualization is healthy, and shows no sign of stalling or topping out.

- VMware is the dominant force with 76% of the installed base. The workload analysis shows that all workload types are migrating to VMware, including mission critical and database workloads.

- Even though VMware is projected to grow at only 24%, VMware will still hold 68% of the overall market in 18 months time.

- Microsoft Hyper-V is projected to grow at 61% over the next 18 months, with an emphasis on smaller Microsoft IT shops, and desktop virtualization.

- KVM is growing very fast from a small base, and is the leading open-source contender by far. It is particularly strong it Hyperscale IT infrastructures (not represented in this survey), an with other IT service organizations such as Cloud Service providers, ISVs, VARs and other distributers.

- OVM from Oracle is focused on large-scale Oracle database installations, and seems to be growing fast in this niche.

- From the evidence of this survey, Citrix Xen is challenged to remain a viable hypervisor.

Source: Wikibon 2013

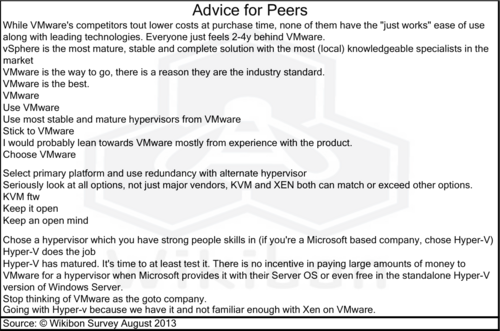

Table 1 shows a selection of advice given to peers by the respondents. VMware installations liked VMware and praised its ruggedness and functionality. Hyper-V installations praised the fact that with System Center Manager Hyper-V was catching up with VMware functionality and was “good-enough” for many workloads surrounding desktop and Microsoft server software. KVM installations praised its low-cost, stability, and strong functionality.

Multi-Hypervisor Impact On Cloud Deployments

Source: Wikibon 2013

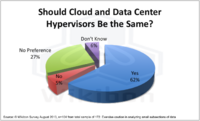

In addition to the increase in virtualization, IT departments are deploying more applications into cloud environments. Users in the survey were asked if they preferred that the hypervisor used in a public cloud deployment should match what they are using in their internal data center today. As seen in Figure 7, nearly 2/3 of respondents stated yes. This is a bit surprising as today, the top hypervisor is VMware and the top public cloud is Amazon, which does not use VMware. Users are either unhappy with the current dichotomy or that as IT takes a more central control that there will be a preference towards similar deployments which is good news for Microsoft Hyper-V, VMware’s vCloud Hybrid service or alternatives such as Rackspace’s Dedicated VMware Offering.

Source: Wikibon 2013

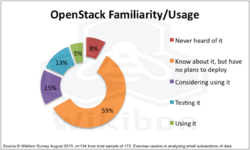

Additionally, the survey asked about customer familiarity and adoption of OpenStack. As shown in Figure 8, over 2/3 of respondents have no current plans to deploy OpenStack. Wikibon would point out that this is typical for any early stage technology and with the rapid evolution of the OpenStack ecosystem; these numbers can easily change in 12 months with maturation of technology and education of the community. The relationship between hypervisor preference and OpenStack adoption will be a hot topic to watch. While VMware has made a strong push towards OpenStack (and is a primary contributor to networking projects due to involvement from the Nicira group), many of the vendors in the OpenStack community have positioned the solution as a way to stop paying licensing fees (by switching to KVM open source alternatives), similar to how other open source projects have been positioned against Microsoft and Oracle licensing.

VMware Storage Integration

Source: Wikibon 2013

As shown in Figure 5, VMware has a dominant position in the hypervisor marketplace, with 76% marketshare today as reflected in the Wikibon 2013 survey. In the last two years, Wikibon has published the result of analysis and surveys on the integration between storage arrays and VMware storage APIs. The reason for this attention to storage was that virtualization acted as a “blender” for the IO from different workloads, and reduced the functionality of the storage arrays to differentiate between (for example) sequential data and random data access.

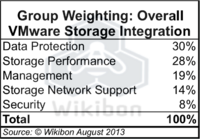

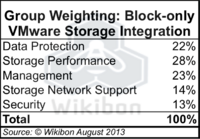

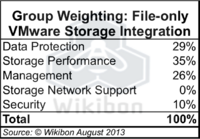

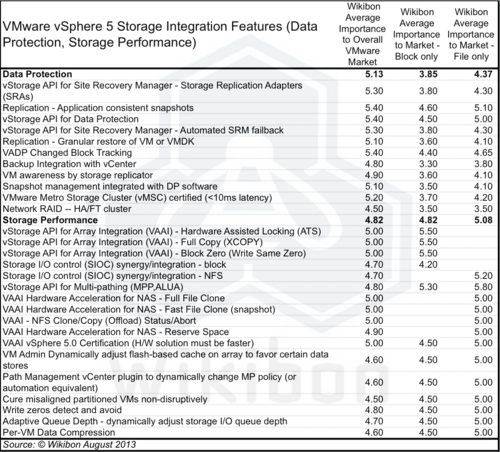

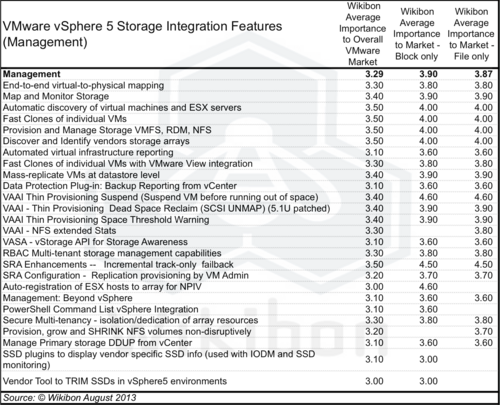

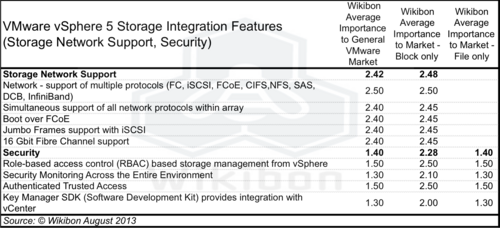

As in previous years, Wikibon has divided up the storage integration functionality into functionality groups. This year there a five groups:

- Data Protection functionality,

- Storage Performance functionality,

- Management functionality,

- Storage Network Support functionality,

- Security functionality.

Source: Wikibon 2013

The VMware APIs and the work of the storage companies are valiant efforts to plug this leaky dyke. Wikibon has assessed three types of storage arrays with VMware storage integration;

- Overall Storage Integration – The overall weighting table is shown in Table 2.

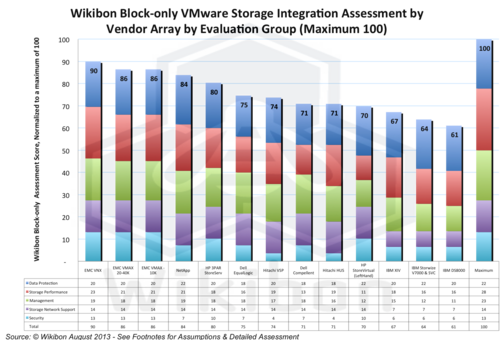

- Block-only Storage Integration – The overall weighting table is shown in Table 3.

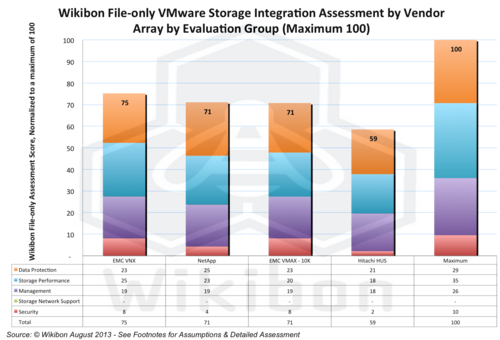

- File-only Storage Integration – The overall weighting table is shown in Table 4.

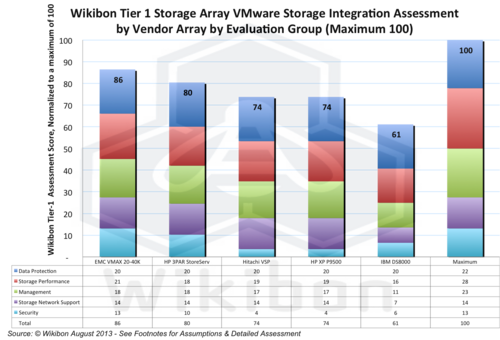

The detail tables with the weightings of specific storage integration functions is shown in the footnotes in three tables:

- Data Protection & Storage Performance for all types of array is shown in Appendix 1.

- Management for all types of array is shown in Appendix 2.

- Storage Network Support and Security for all types of array is shown in Appendix 3.

Source: Wikibon 2013

Wikibon discussed in depth with every vendor the storage integration functionality in each array and included additional suggestions from vendors for additional functionality. Each functional element was assessed as being present in an array, or not (Y/N). Appendix 4 (an eye test table) shows the result of the analysis and consultations with the vendors, updated in October 2013 after additional discussions with some vendors.

The calculations to derive the Wikibon comparison charts are simple in principle. Each functional component is weighted, and this weighting is multiplied by one if the function exists in a specific array and by zero if it does not. The overall scores are normalized to a maximum of 100. The final column shows the maximum score in each functionality group.

The results of the overall assessment of the storage arrays are shown in Figure 9. The EMC VNX leads this category with 86 of 100, with NetApp a close second, and The EMC VMAX 10K is in third position. The HP 3PAR array was next, and the Hitachi HUS, IBM XIV and Hitachi VSP arrays close behind. The Hitachi VSP is the most improved array from 2012. The Dell storage arrays were solid. The other two IBM storage arrays, the Storwize V7000 and DS8000 showed only a little additional functionality compared with 2012.

Source: Wikibon October 2013 Update

The results of the block-only assessment of the arrays are shown in Figure 10. EMC swept this group, with the EMC VNX in first place with 90 points from 100, the EMC VMAX 10K in second, and the EMC VMAX 20-40K in third. The NetApp and HP 3PAR scored well in the 80’s. The Dell Compellent and EqualLogic, together with the HP VSP and HUS and the HP StoreVirtual scored in the 70’s. The three IBM arrays were in the 60’s.

Source: Wikibon October 2013 Update

The file-only storage arrays were a small group of four shown in Figure 11, with again the EMC VNX in first place. The NetApp and EMC VMAX 10K were tied for second place.

Source: Wikibon October 2013 Update

The Tier-1 storage arrays were a small group of five shown in Figure 12, including the HP XP P9500 with the same technology as the Hitachi VSP. The EMC VMAX is in first place, and the newly promoted Tier-1 HP 3PAR in second place.

VMware has recognized for some time that it must make some fundamental changes to the IO architecture to address the VM storage performance problem properly. Wikibon expects these changes to include:

- vVOLs – Virtual volumes that can be associated with a virtual machine independent of the LUN (especially important for snapshots, replication etc.)

- vFlash (a) – For the core Hypervisor, enabling Flash read caches and retaining support for vMotion, DRS HA, and other HA functions

- vFlash (b) – For each VM, giving the ability to build a pool of flash resources, and share them across the storage VMDKs

- vSAN – Ability to create pools of storage from any storage with a “RAIN” design principle integrated by VASA 2.0

These changes will profoundly change the connection to storage arrays, and obviate many of the previous work done. Wikibon expects that the hybrid and flash-only vendors will integrate much more aggressively with the new integration points, despite the best efforts of EMC to slow them down by not giving them early access to the APIs.

The result of this should be a much larger group of storage arrays that will be integrated into VMware storage APIs in 2014 and much better storage integration.

Conclusions

The main conclusions from the survey are:

- Virtualization is continuing to grow

- The survey indicates that the percentage of virtualized servers will grow from 69% today to 84% in two years time.

- Consolidation after Experimentation

- The survey results indicate that today 46% of installations had a single hypervisor, and this would grow to 55% in 18 months time.

- VMware Dominant

- Dominant in functionality

- Of the installations with a single hypervisor in 18 months time, two-thirds would be VMware.

- All workload types were being run in production under VMware,

- …but not growing as fast as the overall virtualization market.

- Hyper-V “Good-enough” for Prime Time

- Of the installations with a single hypervisor in 18 months time, one-third would be Hyper-V.

- ODX support an essential requirement for storage arrays for Microsoft environments.

- Niches for KVM & OVM

- KVM is growing fast from a small base, and is predominately found outside of enterprise installations.

- OVM is growing fast from a small base, and is predominately found in in large Oracle database sites.

The main conclusions from the integration analysis are:

- EMC VNX had the most VMware integration of all the storage arrays analyzed and led in the overall group, the block-only group, and the file-only group.

- NetApp was in second place overall in the file-only group; EMC VNX and NetApp were significantly ahead of the rest of the arrays

- EMC had a clean sweep of the block-only group, with the VNX, VMAX 10K and VMAX 20-40K in first, second, and third place.

- Hitachi was the most improved from 2012, with solid improvement both in the VSP and the HUS lines.

- HP 3PAR scored well in the block-only group.

- Dell storage arrays were solid, with appropriate integration for the lower end of the market.

- IBM did not add any significant improvement over 2012.

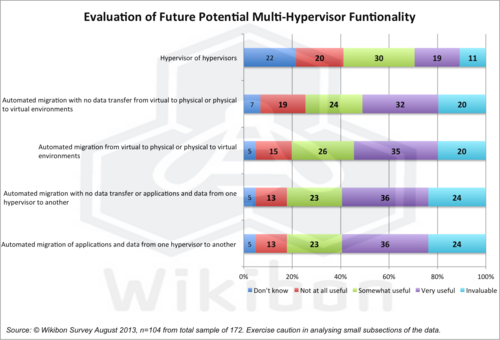

The key functionality improvements for 2014 for storage arrays will include support for new VMware vVols, vFlash, vSAN, support for Microsoft APIs such as ODX, and support for migration between different hypervisor environments. Figure 13 below shows the strong support in the user community for inter-hypervisor functionality.

Source: Wikibon 2013

Action Item: CIOs and CTOs should ensure that workloads stay within the strategic fit envelope of each hypervisor, where there is sufficient workload that fits a hypervisor, lower cost hypervisors are appropriate.

Footnotes:

Source: Wikibon 2013

Source: Wikibon 2013

Source: Wikibon 2013

Source: Wikibon October 2013 Update