Premise

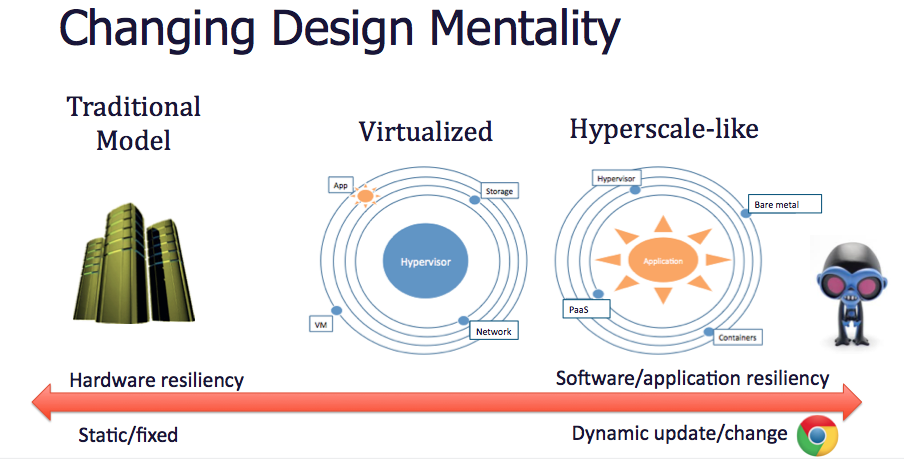

In 2014, Wikibon put forth a market definition and forecast for a new category of infrastructure under the term Server SAN. The premise of the architecture is born from the distributed architectures found in hyperscale companies such as Facebook, Google and Amazon, where infrastructure is a platform that serves the needs of the applications by being simple to scale and manage. Wikibon’s goal of this category was to give guidance on some of the fundamental changes that will occur in infrastructure over the next 5-10 years under the umbrella of Server SAN. A primary outcome of this infrastructure transformation is that there will be a shift away from traditional storage arrays. While this is not the death of storage or reduction in the importance of storage skills, the outcome is that applications and software that focuses on the full infrastructure stack will control storage rather than storage as a bespoke silo. In 2014, the growth of hyperconverged infrastructure (HCI) – which is an early instantiation of Server SAN, but not the entire picture, has exceeded Wikibon’s growth forecast by about 20%. When compared to the market size of server and storage infrastructure that is over $1T, convergence (over $6B in 2014) and hyperconvergence (~ $600M in 2014) are a fast growing, but small piece of the overall market. This year’s update will examine the current state of the Server SAN ecosystem as well as give guidance as to the growth opportunities for innovation and expansion beyond the current generation of solutions.

Server SAN Enabling a Modern Operational Model of IT

Early customer adoption of Server SAN has often been project based (such as for VDI) and there are many differences in the purchase and operations of Server SAN compared to storage arrays or previous converged infrastructure. All converged and hyperconverged offerings promise to deliver simplicity compared to previous infrastructure. This requires a shift in what input the user has on both the design and operations of infrastructure – there is a trade-off of reducing the “geek knobs” by leveraging a more uniform or standardized product. This change can be uncomfortable; IT must have a change agent that can drive the effort, while vendors must be able to make the operator and buyer a hero to the business.

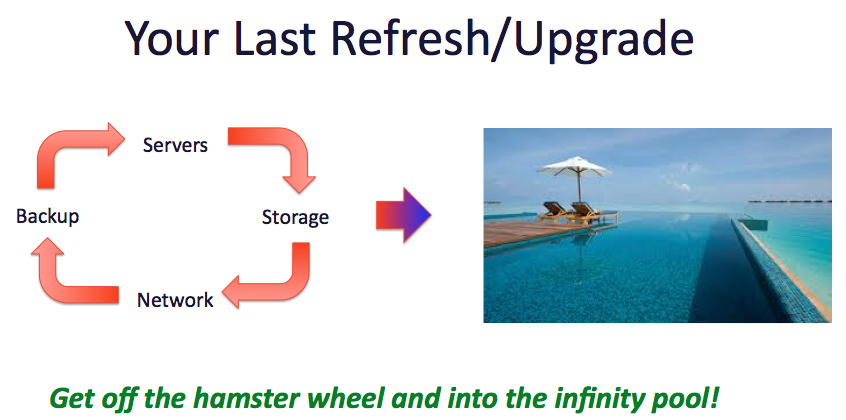

For more than five years, converged infrastructure solutions such as VCE Vblock and NetApp/Cisco FlexPod showed that an integrated offering could be deployed faster and maintained easier than custom configured infrastructure. A fundamental difference between converged and hyperconverged infrastructure is that the building block size of HCI is a full stack in a smaller footprint than the earlier converged offerings. The key of this difference is not solely on the size and makeup, but rather the ease at scaling and managing the solution. In the typical enterprise, budgets are doled out on a yearly basis for a specific type of infrastructure such as servers, storage or network. This budget forcing function requires that IT purchase based on best estimates for what they will need for the next 3-5 years; the purchase, migration and upgrade of the environment is typically filled with lots of angst and pain. The vision of a software-led (or software-defined) data center is one where resources such as compute, storage and network are a pooled resource. A proper Server SAN (or HCI) infrastructure allows those building blocks of IT to become a pool where applications can be added and resources can be scaled up (and potentially down) as needed. This does require a shift in purchasing and operational habits, but just as VMware server virtualization allowed for greater utilization of compute resources, moving to an “infinity pool” of all resources is the simple first step of HCI.

Explosive growth of hyperconverged infrastructure ecosystem

VMware’s launch of Virtual SAN (VSAN) was the single biggest event in the history of hyperconverged infrastructure. VMware’s current dominant position in server virtualization and large ecosystem of technology and channel partners meant that it’s entrance into this market shined a bright spotlight on this emerging area.

VMware marketing of VSAN drove broad awareness and interest in hyperconvergence; every startup in this space saw increased sales calls and a jump in revenue driven by the rising tide. The revenue and growth of this market segment has spurred the large players to take action:

- EMC acquired ScaleIO in 2013 and recently announced that it will be baked into a new VCE offering VxRack

- Dell OEM of Nutanix in 2014

- Cisco’s broad partnering in storage, including investment in Stratoscale and field marketing activities with SimpliVity (See The Next Phase of Converged Infrastructure)

- Many announcements with VMware including VSAN Ready Nodes with server partners (SuperMicro, Lenovo, HP, Cisco) and EVO:RAIL with storage partners (NetApp, HDS, EMC)

- Citrix acquired Sanbolic in 2014 to better compete against VMware

Nutanix is the early leader out of the gate with over $200M in revenue in 2014. The company hired its 1000 employee in early 2015 and all signs point to an IPO in 2015. Nutanix’s core technology is based on Google File System (GFS) and the company has a differentiated “webscale” messaging that is backed up with architects from Google, Facebook and more. Like many of the hyperconverged offerings, Nutanix has a strong channel focus. The company has been expanding outside of its early focus on VDI, expanding geographically and across verticals (they are well known for strong government sales). While Nutanix faces increasing competition, Wikibon’s forecast is that the company can maintain its leadership position through 2015. A key threat is the strained relationship with VMware; Nutanix supports multiple hypervisors, but the majority of customers are using VMware, and VMware is aggressively trying to win the part of the stack that Nutanix owns. Nutanix and many of the HCI vendors have started to position themselves more directly as a storage solution, it is Wikibon’s belief that positioning as a systems solution is still more appropriate, if a bit harder to get companies to embrace the transformational aspects of the architecture.

VMware is the central player in the hyperconverged market today. VMware is must balance how to expand its cut of the ecosystem without disrupting partnerships. As mentioned earlier, many companies have signed up for various VSAN and EVO-family solutions, but it is early days to see what the full solution set will look like and what go-to-market will be successful. In 2014 VMware says they had over 1000 paying customers and growing fast (that number has already surpassed 2k paying customers at this point in Q2 ’15). VMware has immense marketing reach and field engagement, but the partnerships are all “complicated” since most of the big partners have alternative solutions including Dell (Nutanix OEM), HP (StoreVirtual product) and EMC (ScaleIO). From a product perspective, VSAN 1.0 is appropriate for test environments, the new 6.0 code has a feature set that is more appropriate for deployment. VMware is having success selling the solution not as storage, but as an extension of the value of virtualization in simplifying IT and allowing applications to be delivered faster. Accounting for VMware’s revenue compared to other HCI participants is complicated by the fact that VMware’s solution is software (sold with/through a partner that offers the hardware), and often is part of an enterprise license agreement (ELA).

HP has quietly become a leading provider of hyperconverged infrastructure. The HP StoreVirtual solution fits Wikibon’s definition of Server SAN and the solution saw strong revenue growth in 2014. StoreVirtual is the HP branding of what started out as LeftHand, which was originally positioned as an iSCSI storage offering, was one of the earlier software-only storage offerings and hence was one of the first VSAs and after many changes and years of deploying in thousands of environments is a software-defined storage solution. HP’s server leadership puts the company in a good position to expand StoreVirtual and VMware VSAN revenues to be a top 3 player in the market.

If VMware is the central figure in the hyperconverged market, then there is no excuse for its parent company EMC to become a leader in this market. EMC moved early to acquire ScaleIO and has struggled some to position it versus VMware VSAN offerings. ScaleIO technology is showing up in a number of places, most prominently as the first “profile” of the VCE VxRack solution set. VxRack with ScaleIO (code named “Buzz”) is a rack-level architecture that can support multiple hypervisors and physical deployments. While the storage stack does not have a robust set of storage features, its scalability (to hundreds or thousands of nodes) and flexibility make it a strong fit for service providers and global enterprises. Wikibon interviewed early-adopter Itrica at EMC World – see the full customer interview. Most hyperconverged solutions target the mid-range, so if EMC can start knocking down deals in the millions of dollars, they can rapidly climb the leaderboard in this market.

While most hyperconverged infrastructure solutions gravitate towards the midrange, SimpliVity OmniStack is positioned directly at the traditional enterprise and mission critical applications. Not only does SimpliVity have a robust stack that pulls together the functionality of over a dozen traditional devices into a single appliance, the vast majority of customers are also deployed with replication (another built-in feature which is often difficult for more seasoned companies to deliver successfully). While some HCI solutions only look to check the box for features like dedupe, SimpliVity’s strong engineering heritage allows it to create the best in class solution for storage efficiency. SimpliVity is balancing between the messaging that resonates with traditional enterprise buyers (reliable infrastructure for mission critical applications) as well as being a delivery mechanism of modern hyperconverged infrastructure. SimpliVity has yet to show how it can be an open platform that can engage a broader community and tie into potential threats to all infrastructure players such as containers, PaaS and OpenStack.

Scale Computing is a well-established HCI startup who is practically unchallenged in the SMB marketplace. As many of the others are struggling with how to interact with VMware now that it has VSAN; Scale Computing left that discussion in the past since it is built with KVM. When asked why public cloud hasn’t consumed all of the IT in SMBs, Scale’s CTO stated that every customer has at least one application that IT must fully own/control. Scale Computing provides a simple and cost effective solution for that application and expands from there.

Dell has the broadest portfolio of HCI options including partnerships with Nexenta, VMware, and the Nutanix OEM. So many options means that Dell can compete for in many deals, but typically its sales reps are not leading the discussion. Dell has a strong VDI practice (see Wikibon research on the full Dell/Nutanix VDI stack) and has some software assets, but needs to be more focused to be successful in HCI. Dell servers are inside the standard SimpliVity offering, that is simply a supplier relationship, SimpliVity has more strategic activity with Cisco.

There are a number of other startups in the space. Maxta is software-only that is certified in both HP and Cisco server environments. NIMBOXX is a KVM-based solution that also offers its own full VDI stack, all of it open-source (they are also on the Open Compute board). There have been rumors of Cisco doing another spin-in or acquiring a player to expand its UCS line and expand into the storage space; it is Wikibon’s belief that Cisco has too many deep storage partnerships that would be jeopardized and that the overall economic outcome would be questionable at best.

There are some interesting companies that follow many of the architectural philosophies of Server SAN without being hyperconverged. In the all-flash array market, Wikibon CTO David Floyer laid out the framework for a “scale-out shared data architecture” and while no current solution meets this full definition, SolidFire and EMC XtremIO have the best scale-out offerings that are furthest down this path. Some HCI solutions offer all-flash offerings, but it is rare to see them in deployment. While flash is driving much of the storage discussion, the capacity side of storage also has strong growth in the scale-out area. EMC Isilon is over $1B in revenue and companies like Scality, new startup Qumulo (from the founders of Isilon), and cloud solutions from AWS and others are meeting the challenges of capacity.

The limits of hyperconvergence and the promise of Server SAN

The goal of infrastructure is to support applications and while applications are undergoing a renaissance in modernization, most applications are not yet “cloud native”. Server SAN is defined as turning infrastructure into a platform that is appropriate for the full spectrum of applications, whether they be virtualized, physical or in a container (Docker, Rocket, etc). When we talk about HCI solutions, the discussion is often about scale and how many nodes it can support. In customer environments, the only thing that matters is will it support the applications and growth for the lifecycle of the solution. A true “future-ready” infrastructure platform must be a distributed architecture and have full APIs to allow other services to be leveraged. An argument against building HCI into the VMware hypervisor is that there are very limited services that can be added in and the integration takes time. Cloud platforms like AWS and OpenStack can allow for integration of new software and therefore are more flexible. There is an opportunity for Server SAN solutions to leverage OpenStack as an enabler of not only new technologies, but other applications. While hyperconverged infrastructure is a modern application, the reality today is that almost all applications used on HCI are the same ones that lived on a SAN in the past – VMs living in a new place, not Hadoop or noSQL and definitely not the micro services or containers of cloud native applications. As shown in Figure 2, the future of infrastructure needs to keep up with the rate of change in applications, security and business.

As the solutions in the Server SAN marketplace expands, there are some sub-categories that emerge, not everything fits under the hyperconverged infrastructure moniker. Wikibon recently introduced Flash as Memory Extension (FaME), which is a high performance segment of the Server SAN hierarchy.

Action Item: Even in these early days of hyperconvergence, IT can greatly simplify the way that infrastructure is purchased and managed, so that more time can be focused on delivering on the needs of the business. Server SAN delivers a vision for users to ask suppliers for a roadmap that can meet the rapid pace of change. IT must determine the appropriate activities that it must do itself and what items can be better delivered through partnerships or adoption of new technologies.