There is a natural ebb and flow to an emerging technology market. Periods of intense innovation are followed by an abundance of available capital that, as sure as night follows day, flows into a a seemingly endless parade of start-ups seeking to commercial said innovation. That’s precisely what we’ve seen in the Big Data market over the least three to four years.

But the good times can last only so long. Soon, enterprises looking to exploit the innovative new technology run into technical and political roadblocks, and they turn to their tried-and-true IT vendors for help. What often follows is a wave of consolidation, where a small group of start-ups live on as independent entities, another small group of start-ups with strong technology (but not always the revenue to go with it) have successful exits and get acquired by the IT mega-vendors, and the rest of the start-ups disappear into the night.

The questions are will this pattern play out in the Big Data market and, if so, when will the wave of consolidation begin? And if it has already begun, does that mean venture capital for Big Data start-ups is about to dry-up? Where is this market going?

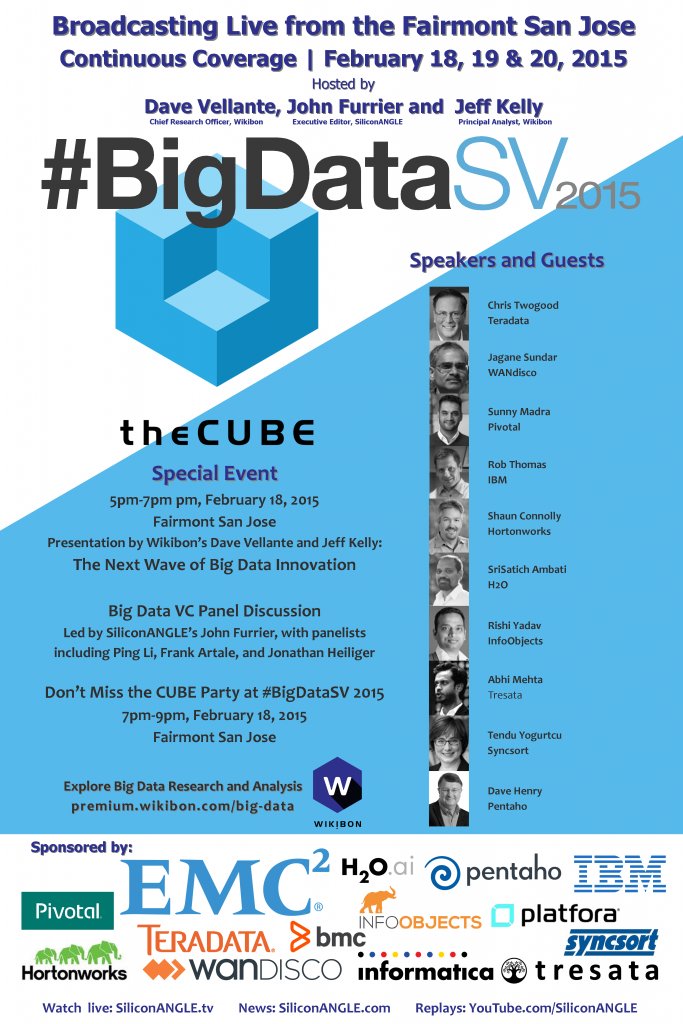

These are a a few of the questions we’re going to explore at #BigDataSV 2015. The event takes place at the Fairmont San Jose Wednesday (2/18) through Friday (2/20). In addition to three full days of live theCUBE broadcast (which will stream live at SiliconANGLE.tv), Wikibon and theCUBE are also hosting an evening event on Wednesday, including a presentation by Wikibon and a Big Data venture capitalist panel discussion followed by theCUBE party. More details, including scheduled guests and panelists, follow in the below event poster. To RSVP, please visit the #BigDataSV Eventbrite page (like theCUBE broadcast, you can watch the presentation and panel discussion live at SiliconANGLE.tv). And for a more in-depth preview of the event, watch the preview Cube Conversation recorded at Wikibon HQ on Thursday (2/12).