Predictions about enterprise tech have never been more uncertain. Predictions become even more challenging when you try to make forecasts that are measurable. Generally, our belief is we should be able to look back a year later and say with some degree of certainty whether the prediction came true– ideally with some quantifiable evidence to back that up.

In this Breaking Analysis and for the third year in a row, we collaborate with Erik Bradley of ETR and to share our annual enterprise technology predictions.

Over 1,000 Inbound Predictions

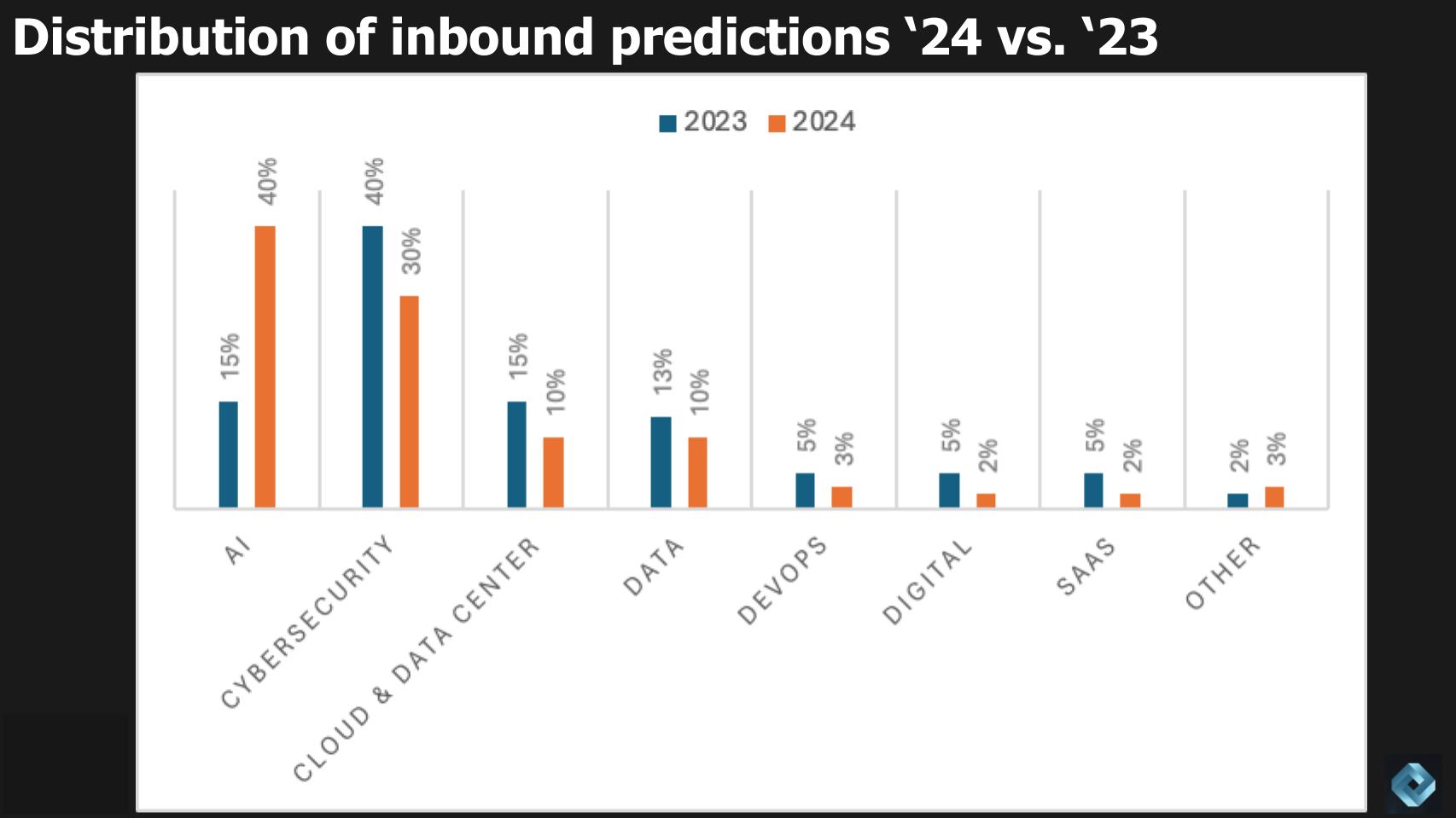

Since we started this tradition, public relations folks have kindly provided their clients’ perspectives on the trends to watch in the coming year. The graphic above shows the change in the lead categorical topics from these outreaches relative to last year.

It’s no surprise to see a huge jump in AI predictions, which are partially understated because virtually all these categories included some AI content. Cybersecurity is down but still prominent followed by cloud, data center and data/analytics. Then a smattering of DevOps, Digital, SaaS and some other tidbits.

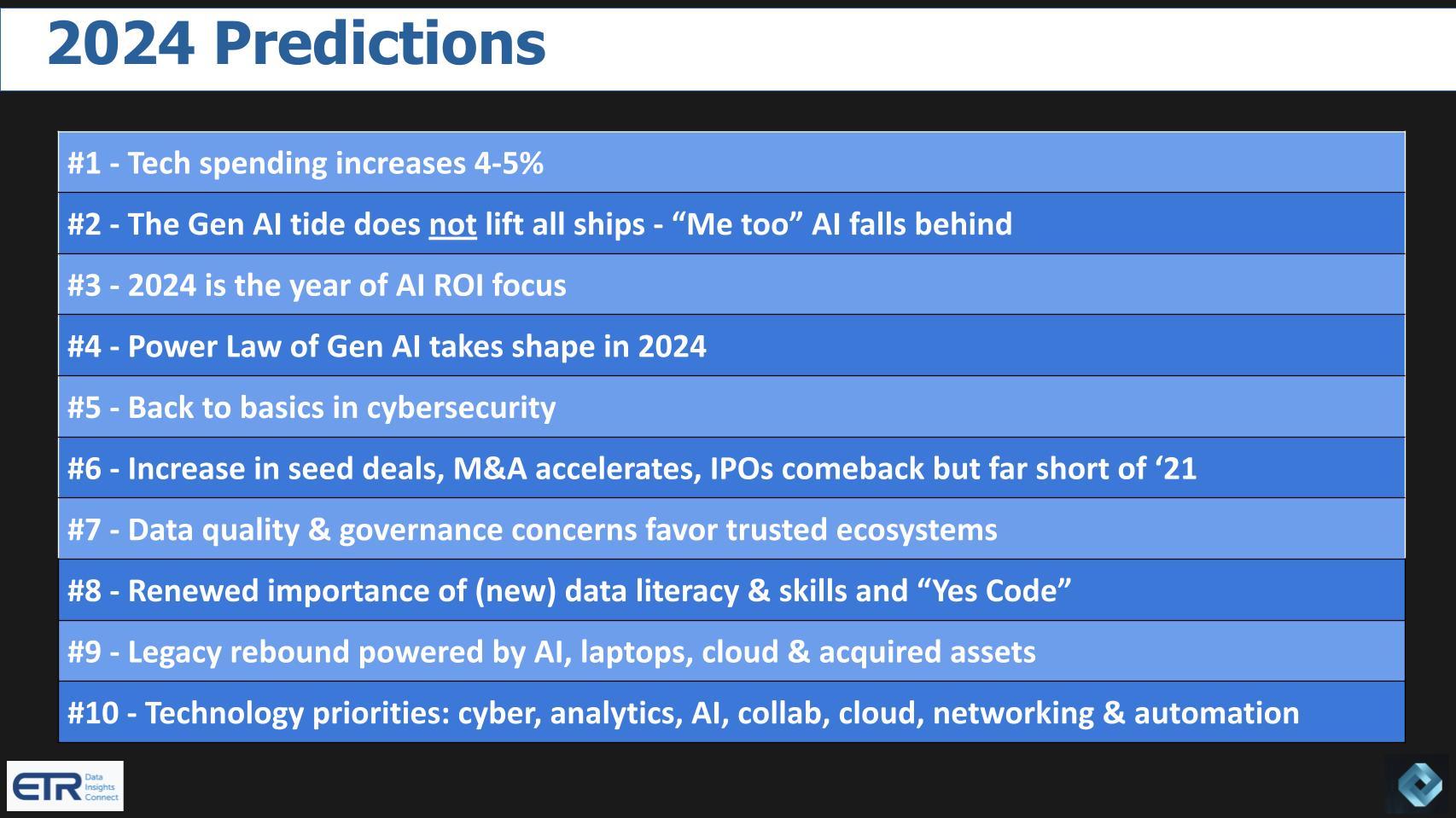

A Snapshot of our 2024 Predictions

Here are two other resources you may be interested in reviewing:

- Our look back on 2023. Grading last year’s predictions.

- Predictions from our collaboration with members of theCUBE Collective and the “Data Gang” focused on data.

Below is a quick scan and run down of this year’s predictions where we cover the macro IT spending environment, the state of generative AI, AI ROI, cybersecurity, M&A, data quality, governance, skills, momentum for legacy players, and 2024 technology priorities.

Ok let’s get started…

#1 – Tech Spending Increases 4-5% in 2024

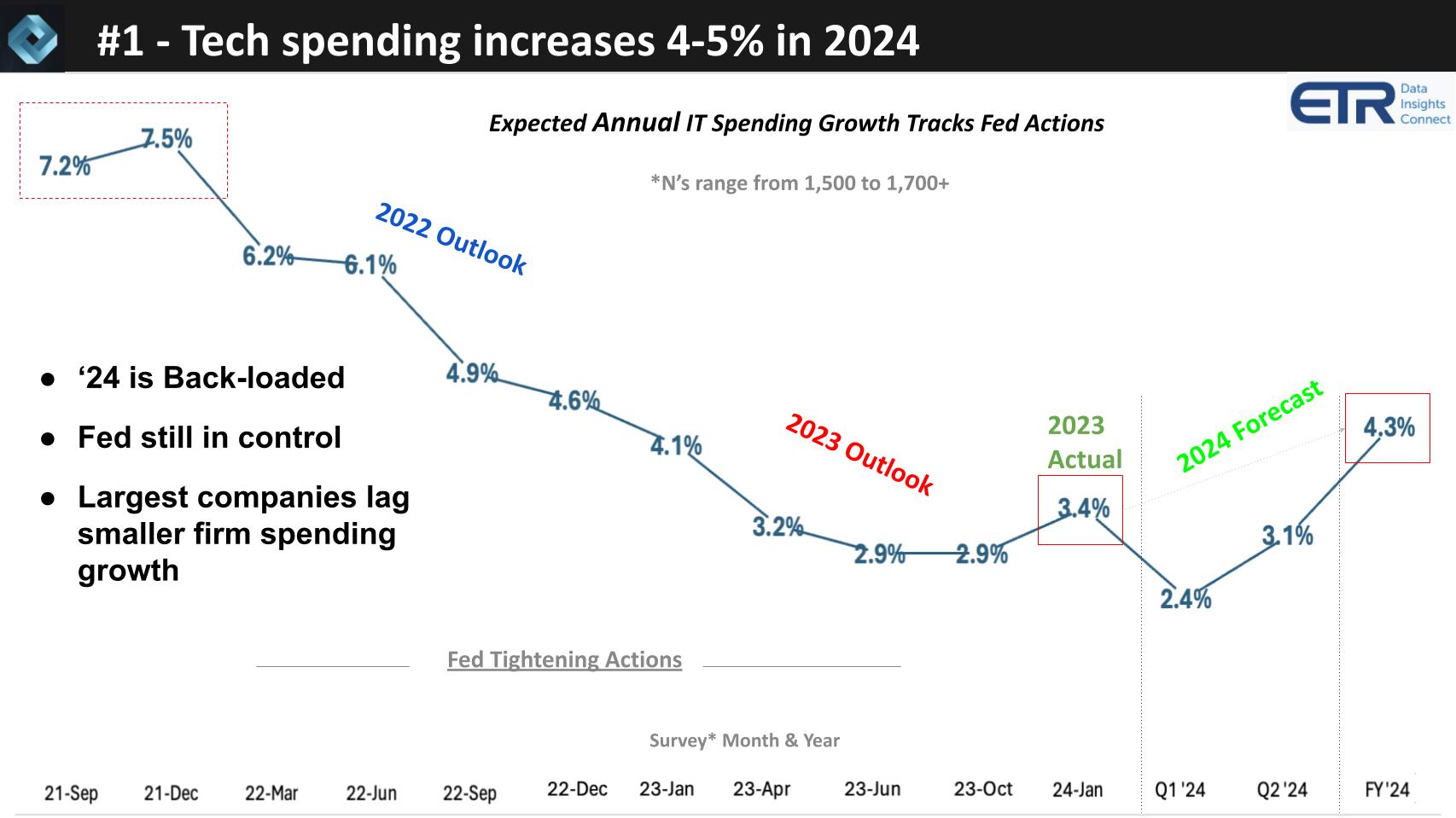

The graphic below shows the annual tech spending growth expectations from more than 1,500 IT decision makers (ITDMs) at different points in time.

ITDMs exited the isolation economy, very enthusiastic with execs expecting their tech budgets were going to increase 7.5%. We know what happened. Ukraine, Fed tightening and all through 2022, we saw those expectations for the year go down. After the Fed stopped tightening, we saw a flattening out of expected annual growth at 2.9%.

ITDMs on average said that in 2023, their spending ended up growing at 3.4% in 2023. You can see the forecast for 2024 is 4.3%, but it’s back-loaded with Q1 and Q2 2024 expected to grow at 2.4% and 3.1% respectively.

The following additional points summarize our research and predictions:

Our analysis indicates a cautiously optimistic outlook for spending trends in the IT sector. Key observations from this discussion are as follows:

- There has been a notable increase in spending after a significant decline over the past six quarters. This trend reversal is particularly evident in large corporations, with Fortune 500 companies increasing their spending budgets from 1% to 3% since July.

- Small companies, however, continue to lead in terms of spending growth, currently at about 6.5%, compared to the larger companies.

- Despite the increase, there’s a notable disparity in spending between small and medium businesses (SMBs) and larger Global 2000 companies, with SMBs almost doubling the spending rate.

- The broader market remains cautious due to uncertainties, with organizations adopting a quarter-by-quarter approach, largely influenced by earnings estimates and overall economic conditions.

- The Federal Reserve’s policies and actions continue to play a significant role in shaping market expectations and spending behaviors.

- Positive indicators in the IT sector include the conclusion of rigorous cloud audits and a rise in new IT projects. Additionally, there’s an increase in Net Score spending in IT consulting and services, traditionally seen as a leading indicator of broader spending trends. Note: Net Score is ETR’s proprietary methodology to measure spending momentum.

In summary, our opinion on the macro is that these developments, particularly the increased engagement of large organizations in spending and the positive signs in the IT sector, paint a cautiously optimistic picture for the continuation of this spending trend throughout the year. However, the ongoing caution due to macroeconomic uncertainties, the backloaded nature of the forecasts and the significant role of the Federal Reserve’s policies cannot be overlooked.

#2 – AI is not (yet) a tide that is lifting all ships

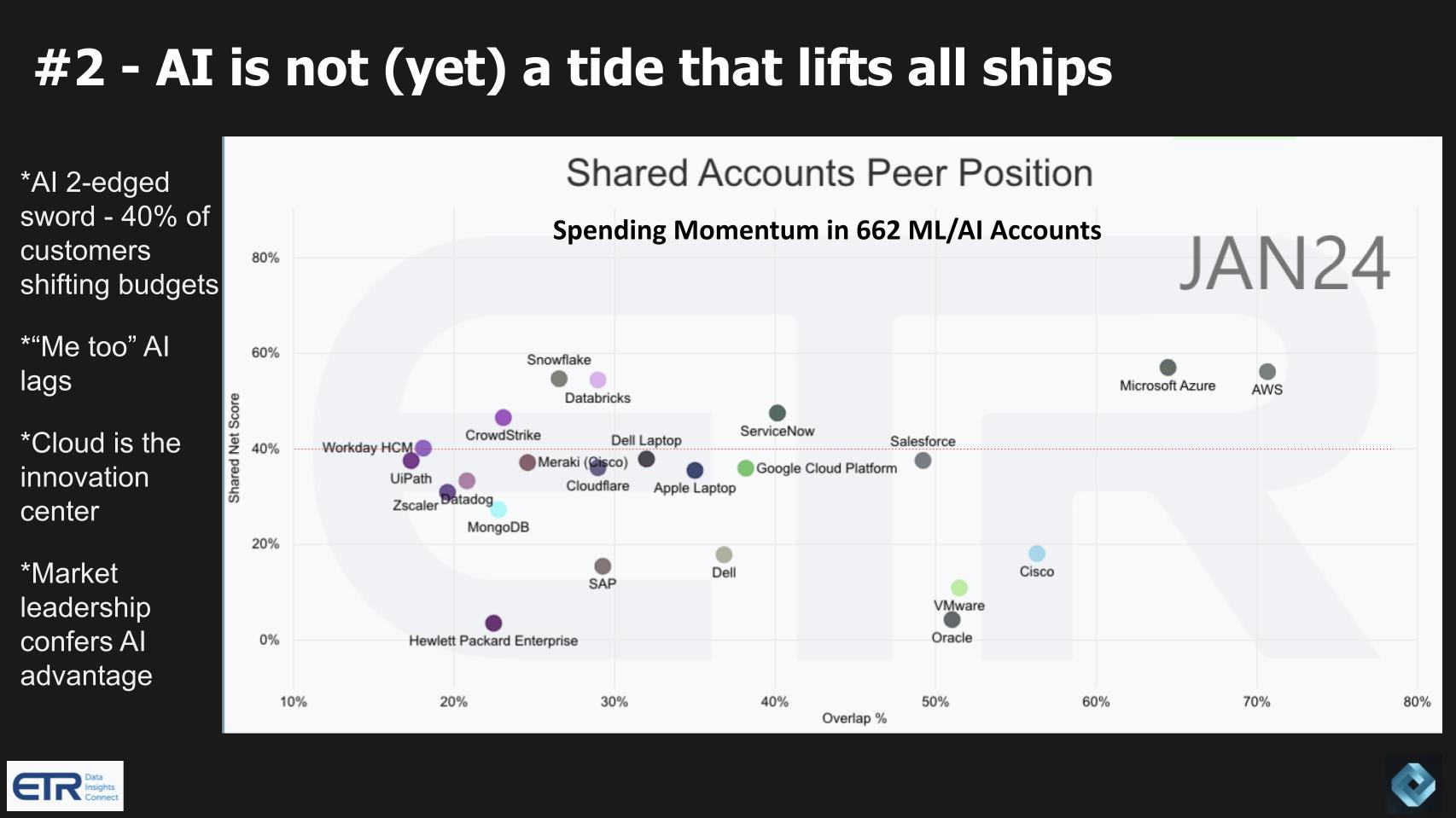

The graphic below shows data that measures spending momentum or Net Score on the vertical axis and the presence of a company/platform within the survey set of more than 1,700 respondents on the horizontal axis. This cut isolates those 1,700 down to 662 ML/AI accounts. So it’s a measure of the prominence of various companies, platforms and products within those 662 ML/AI-heavy accounts. The red line at 40% indicates a highly elevated spending velocity.

There’s a popular narrative that AI is benefitting everybody. We don’t think this is the case and we believe it will become more evident in 2024. Specifically we see a market of AI haves and have nots. AI in our view is a two-edged sword. In some cases it can be a tailwind. Pure play AI companies like OpenAI, Anthropic, Hugging Face and some others are obviously benefitting from the trend. Notably, the public cloud vendors and even the specialized AI clouds like CoreWeave, Core42, Lambda and Genesis Cloud are certainly benefitting from the elevation in mindshare. However, 40% of customers say that their AI funds are coming from other budgets.

Forty percent of customers indicate that their AI budgets are stealing from other buckets…

AI is Lifting Market Leaders Executing on a Cogent AI Strategy

Our prediction is that in 2024 we’ll see a divergence between those companies delivering meaningful AI value and those delivering “me too AI” will lags. In the January data above, you can see the platforms that have AI affinity. Microsoft with Azure and its OpenAI partnership. AWS is prominent as well and they’re both above that 40% line. Notably, Google is far below those two despite their AI investments and capabilities.

ServiceNow’s recent quarterly results indicate AI is a tailwind. Databricks and Snowflake have high AI alignment, as do CrowdStrike and Zscaler. Salesforce is pounding its AI messaging in television and digital ads Workday is building AI into its SaaS products, as is Oracle. Interestingly we also see laptops from Dell and Apple as prominent. Apple has for years shipped products with diverse silicon from its Arm-based internal development efforts, including not only CPU but GPU and NPU capabilities.

Others like MongoDB are adding vector embeddings, which have been well accepted and support the creation of retrieval augmented generation (RAG) capabilities. Others like Cisco, which is not seen as an obvious AI company, are benefitting from acquisitions such as Meraki. HPE’s acquisition of Juniper was in a large part about bolstering its AI capabilities.

While companies are making moves, not all will be successful in terms of generating revenue and shareholder value and we predict that will become more obvious in 2024 with a bifurcated market.

Me Too AI vendors will sink -Mike Finley, CTO of AnswerRocket

The following additional points summarize our research and predictions:

- Hyperscalers are currently reaping the most benefits in the market. As well, companies like Snowflake and Databricks, known for their sophisticated data management capabilities, are becoming increasingly important in the AI journey.

- Cisco Meraki stands out as a bright spot in Cisco’s recent quarterly report, excelling in networking and unified endpoint management. This success story underscores the diverse impact of technological advancements across different sectors.

- General AI (Gen AI) is not uniformly boosting all segments of the tech industry. The most intriguing battleground appears to be in the RPA sector, where Gen AI could potentially revolutionize or even marginalize traditional RPA solutions.

- There’s an interesting dynamic in the RPA market, particularly with leading players like Power Automate, UiPath, and Automation Anywhere showing strong alignment with OpenAI adoption. This alignment seems to be creating spending momentum in the sector for these leaders but not so for others without that alignment.

- Our research suggests that market leaders who effectively integrate and execute AI strategies, avoiding superficial applications (i.e. “AI washing”), are likely to emerge as leaders in the AI space. This includes partnerships across the ecosystem and genuine applications of AI technologies.

In summary, our view is that the technology sector is experiencing a transformative phase, with hyperscalers and sophisticated data companies leading the way in AI applications. The RPA sector, in particular, presents an intriguing area of development, where the integration of Gen AI could redefine market dynamics. The success of companies in this evolving landscape appears to hinge on their ability to genuinely embed and execute AI strategies, rather than merely market superficial applications.

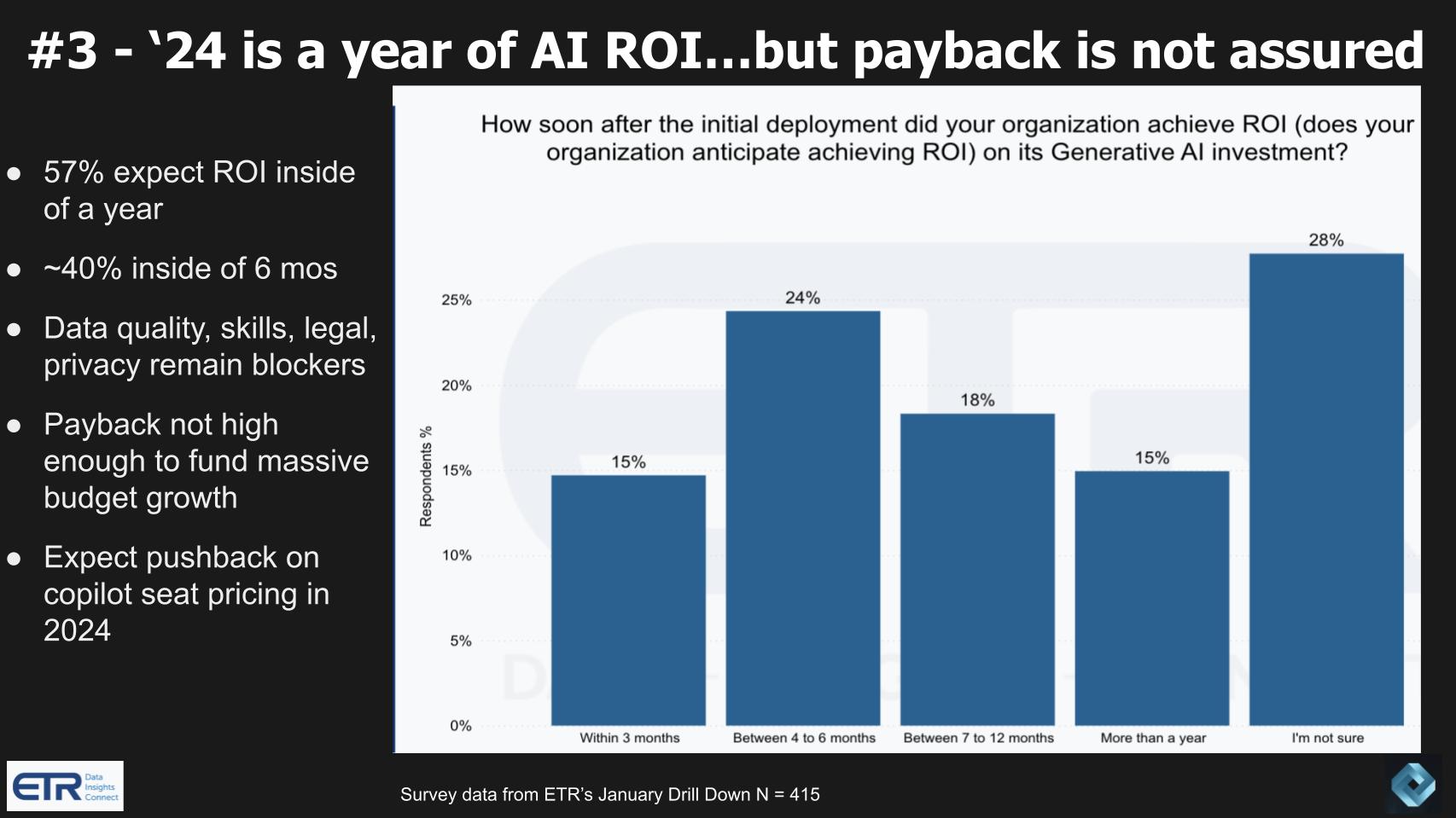

#3 – 2024 is a year of AI ROI…But Payback is not Assured

The graphic below is from an ETR Drilldown survey exploring the ROI of AI. It is not precise in that it allows the respondent to interpret the question as either breakeven (time to positive value) or hitting their ROI targets.

Our analysis covers several key points:

- A significant majority (57%) of organizations expect to achieve ROI from Gen AI within a year, with 40% anticipating this within six months. This suggests a high level of confidence in the efficiency and effectiveness of Gen AI technologies.

- Despite the optimism, challenges such as data quality, skill set requirements, legal and privacy concerns remain significant headwinds.

- There’s a notable concern that AI budgets are impacting other areas, leading to budget compression in some sectors. This underscores the prioritization of AI initiatives over other investments.

- The cost of implementing Gen AI, particularly in terms of per-seat licensing fees, is a growing concern. Organizations are cautious about the scalability of these costs, especially when considering enterprise-wide deployment.

- Currently, the market is in a testing phase with Gen AI, where pricing pushback is minimal. However, this could change as full-scale implementations progress.

- ETR survey data indicates that 25% of ITDMs say their organizations are not actively evaluating Gen AI. While this highlights a preponderance of adoption it’s a warning to see that it’s not nearly 100% as those companies not thinking about applying Gen AI to their business will fall behind.

- The source of funding for Gen AI initiatives is split, with almost half the organizations using new funds and the other half reallocating budgets from other areas, including non-IT departments and productivity applications.

- In certain industries like financial services and manufacturing, there’s a notable trend of reallocating budgets from RPA to Gen AI, raising concerns about the impact on existing automation investments.

- Anecdotal evidence suggests that the perceived benefits of Gen AI, such as significant labor cost savings, might outweigh concerns about licensing costs if the technology delivers on its promise.

In summary, our analysis suggests that while there is a high expectation of achieving ROI from Gen AI within a short period, there are also significant challenges and concerns, particularly regarding budget allocation and pricing models. The reallocation of funds from other areas, including RPA budgets, indicates a strategic shift towards Gen AI. However, the ultimate success and acceptance of Gen AI in the market will depend on its ability to deliver tangible benefits and justify its implementation costs.

The bottom line on this prediction is there are two possible outcomes we’re predicting: 1) AI ROI is evident and fuels an increase in overall tech spending; or 2) AI fails to deliver on its expectations for 2024 and tech spending remains tepid. Our base case is AI ROI will not throw off enough free cash flow in 2024 to provide “gainshare” funding that increases overall IT spending beyond the expected average.

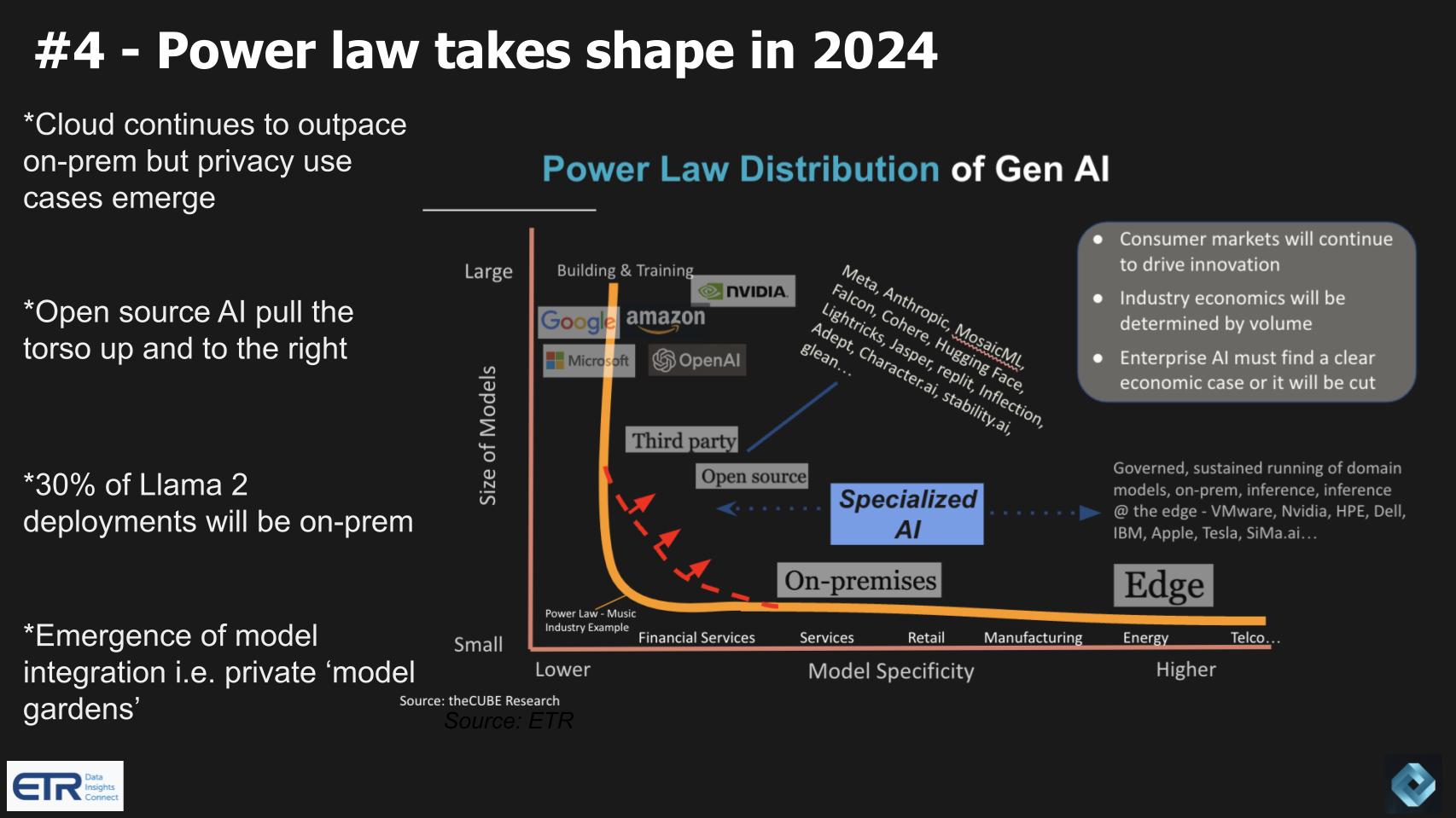

#4 – The Gen AI Power Law Begins to Takes Shape in 2024

The Gen AI Power Law developed last year by theCUBE Research team attempts to articulate how we see generative AI and LLMs evolving. Unlike some industries (e.g. the music industry of yesterday) where a few dominant players ‘own’ the market and there’s a long tail of super small players, we see Gen AI as somewhat different.

While the hyperscalers are dominating the market for large models (size of model on the vertical axis), we see an emerging market for specialized models with domain knowledge that are smaller (horizontal axis). While the long tail is similar, the torso is pulled up and to the right by open source and independent company models.

Additional key points in this prediction include:

- While the cloud giants are currently leading with large models, there’s a notable influence of open-source initiatives (like Llama 2) and independent players, shaping the industry’s trajectory.

- Despite cloud dominance, we predict a more balanced trend starting in 2024 towards on-premise deployments, driven by privacy and data sovereignty concerns. Our research indicates about 30% of Llama 2 deployments are estimated to be on-prem, with some analysts believing it could be as high as 50%.

- There’s a resurgence in hybrid cloud models, with a strong preference for private cloud solutions. We attribute this to concerns around data control and regulatory issues in Gen AI.

- Companies with sensitive competitive data are particularly cautious about cloud deployments, opting for private clouds to maintain control over their data.

- The industry is still in an early phase, and it’s too early for companies to fully trust cloud-based solutions with their sensitive data.

- A recent ETR AI study shows a split of 50:50 between people saying that they’re going to develop their own AI solutions using open source, whether it’s Anthropic or OpenAI etc., and the other 50% are still hoping that it’ll become embedded in their already trusted vendors. Those vendors have window, but it’s not that large of a window. They need to start rolling out their capabilities and communicating their AI roadmaps if we’re going to see that trend take shape.

In summary, our analysis suggests that while the cloud giants currently dominate the Gen AI space, there’s a significant desire from many public companies towards on-premise and private cloud deployments due to data privacy and regulatory concerns. We predict in 2024, the industry will see the early stages of the power law taking shape, with a long tail of specialized AI and a growing emphasis on data sovereignty. This trend is expected to become more pronounced over time underscoring a diverse and evolving Gen AI landscape.

Here are some inbound 2024 predictions from the community related to this topic:

The gen AI dialogue is going to move from theory to practice and is going to focus more on inference. -John Roese, CTO of Dell Technologies.

Specialized AI will take shape and open source models will emerge. -Quentin Clark, General Catalyst

Hypermodal AI, which combines different AIs with other data sources will emerge. -Bernd Greifeneder, CTO Dynatrace

Gen AI has to be viewed as a feature of industry solutions, not a solution in and of itself. -Bryan Harris, CTO SAS

We’re headed more toward a Gen AI monopoly. Patrick McFadin, DataStax

We agree that these domain-specific AIs are going to see a long tail begin to emerge in 2024. Regarding Patrick McFadin’s prediction, we hope not. We agree that hyperscalers right now are in the leaders with the need to build and perfect large models. This has to happen before higher quality, high volume inference begins to dominate. But if he’s correct, this prediction will fail in the long term.

Of note, McFadin predicted back in November that regulators are going to come raining down on these big cloud companies. That prediction has already come true with Lina Khan’s actions this week.

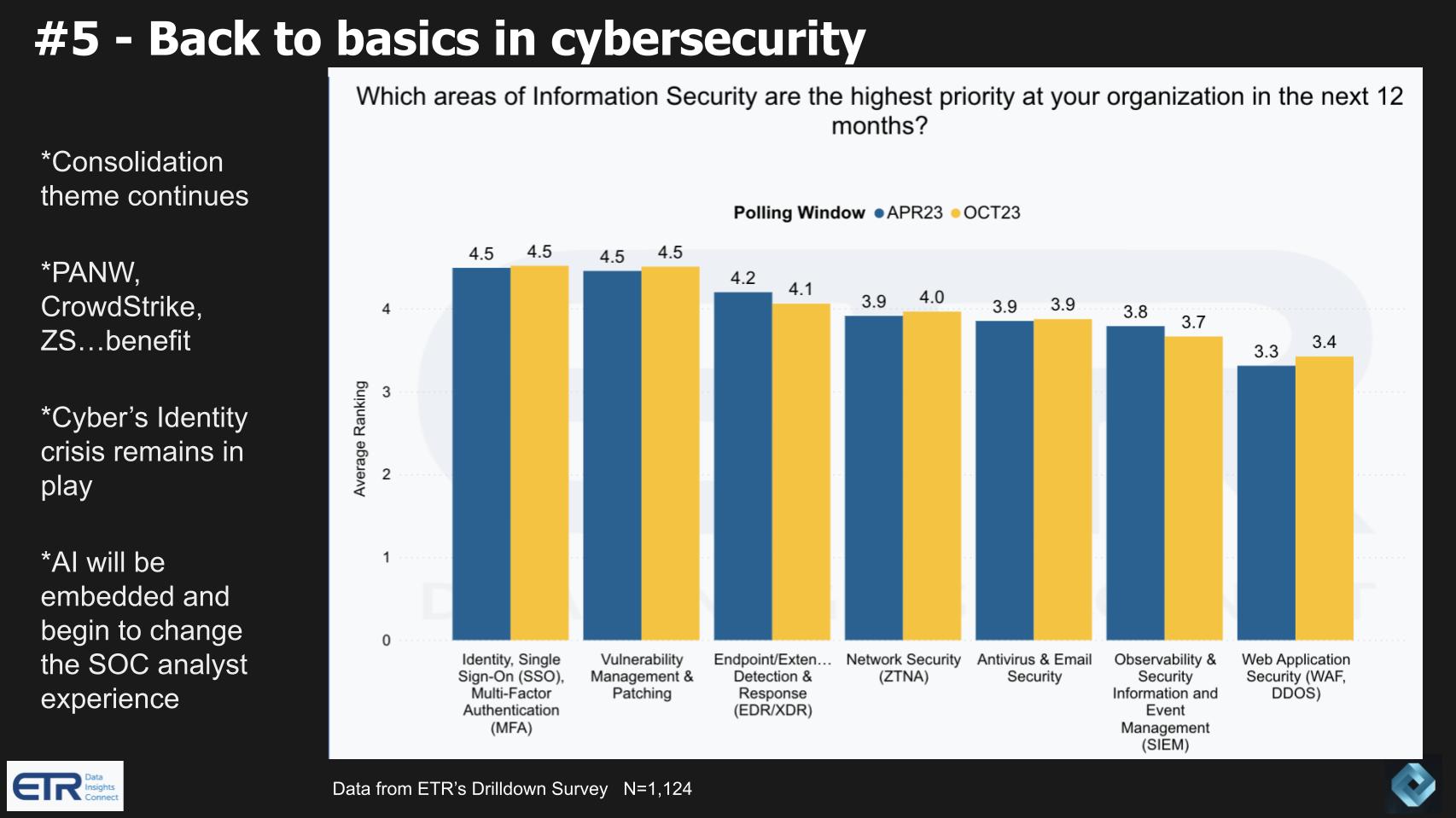

#5 – 2024 Sees Back to Basics in Cybersecurity

The chart below drills into ITDMs security priorities in the coming year.

Our analysis of this data and predictions call for a notable shift towards fundamental security measures, coupled with the continued evolution and integration of AI technologies. Key points from our research supporting our predictions are as follows:

- We believe that AI, despite its prominence in headlines, will become increasingly embedded in cybersecurity, particularly supporting areas such as identity and single sign-on, vulnerability management, endpoint, and network security.

- Our research shows that these aspects of information security are currently the highest priority in organizations, emphasizing a back-to-basics approach.

- We predict that the consolidation trend within cybersecurity will persist, favoring major consolidators like Palo Alto Networks, CrowdStrike, and Zscaler. This trend is noteworthy, especially considering the decline in vendor consolidation as a cost-reduction method relative to last year. We predict that cybersecurity will be less susceptible to this trend than other sectors of the market.

- Despite this consolidation, we believe that the crowded nature of the cybersecurity space will continue to present significant challenges to the industry, as highlighted by the ongoing identity crisis the industry is facing (pun intended).

- We note the increasing role of AI in changing the Security Operations Center (SOC) analyst experience, exemplified by developments such as CrowdStrike’s announcement of their LLM, Charlotte.

- Our analysis also indicates a significant willingness among Chief Information Security Officers (CISOs) to explore cybersecurity solutions from startups, suggesting an openness to innovation and cutting-edge technologies in this sector, which will further compound the crowding effect in this space.

- That said, our prediction and advice is there will be a noticeable shift in focus among security experts to avoid tools creep toward prioritizing basic security hygiene practices like employee training, penetration testing, asset management, and vulnerability patching.

In summary, our prediction for the cybersecurity sector in the coming year is a dual emphasis on foundational security practices and the strategic integration of AI. This approach, along with continued market consolidation and openness to innovation from startups, signals a dynamic and evolving landscape in cybersecurity that will remain problematic. Leading practitioners will take a back to basics approach as the most effective means of stopping breaches.

Here are some inbound 2024 predictions from the community related to this topic:

65% of organizations are not confident that their, not very confident their organizations could fully recover from a data loss incident. -Dell Technologies Global Data Protection Index

52% of production data is backed up on tape still. So everybody says tape is dead, no it’s not. And 61% of production data is also backed up in the cloud. -Veeam’s Data Protection Trend Report

Voice is going to become the new fingerprint. -Aron England, CPO and CTO of Rev.

Over-hyped tools drive the need for security operations. -Nick Schneider, CEO, Arctic Wolf

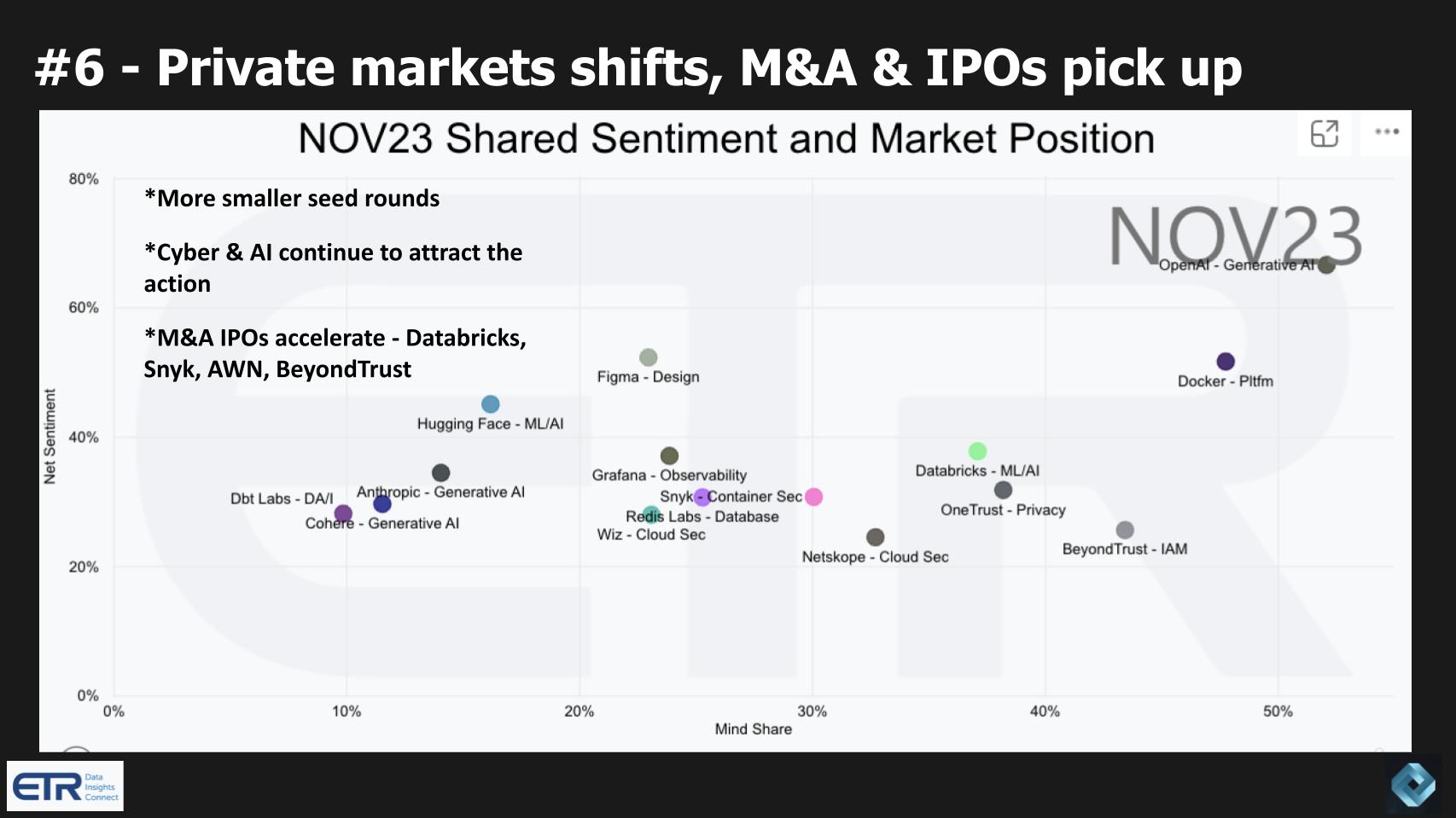

#6 – Private Market Shifts, M&A & IPOs Pick Up

In cybersecurity, 2023 saw 437 funding rounds and M and A transactions with $8.6 billion raised over 346 rounds and 91 total acquisitions last year. -Mark Sasson, Pinpoint Search Group

Our analysis of the private market, mergers and acquisitions (M&A), and initial public offerings (IPOs) in the technology sector reveals several key trends and predictions:

- We expect a significant shift in the private market, with a particular focus on earlier stage emerging technology companies with smaller investments. This is evidenced by strong spending momentum and increased intent to engage with these companies.

- Companies like OpenAI, Docker, Databricks, OneTrust, BeyondTrust, Netskope, Grafana, and Snyk are notable for their high mind share and intent to engage, as per the emerging technology survey (ETS).

- We predict an acceleration in M&A activities and IPOs in the technology sector. Companies such as Databricks, Snyk, Arctic Wolf, and BeyondTrust are likely candidates for IPOs, following a downturn in the number of IPOs last year.

- Despite an expected increase, we do not anticipate a return to the IPO levels seen in 2021. This suggests a more cautious and selective approach in the current market environment.

- We also foresee an uptick in smaller seed rounds and startups, especially in the realms of AI and cybersecurity. This trend is driven by the efficiency and potential of AI technologies, making it an opportune time for new company formations.

- On the private equity side, there is an expectation of increased activity due to previously accumulated funds and a warming investment environment.

- We identify specific companies, such as Cohere, Hugging Face, Wiz, and Snyk, as prime candidates for acquisition, given their strong performance and growing mind share in the sector.

In conclusion, our prediction is that the technology sector, particularly in AI and cybersecurity, will experience a resurgence in M&A and IPO activities to levels above those seen last year but less than half of those from 2021. This trend is underpinned by the tech sector’s improving performance, strong balance sheets, AI imperative and the high potential of emerging technologies. The increase in smaller seed funding rounds also indicates a vibrant and evolving startup ecosystem, particularly in the AI and cybersecurity domains.

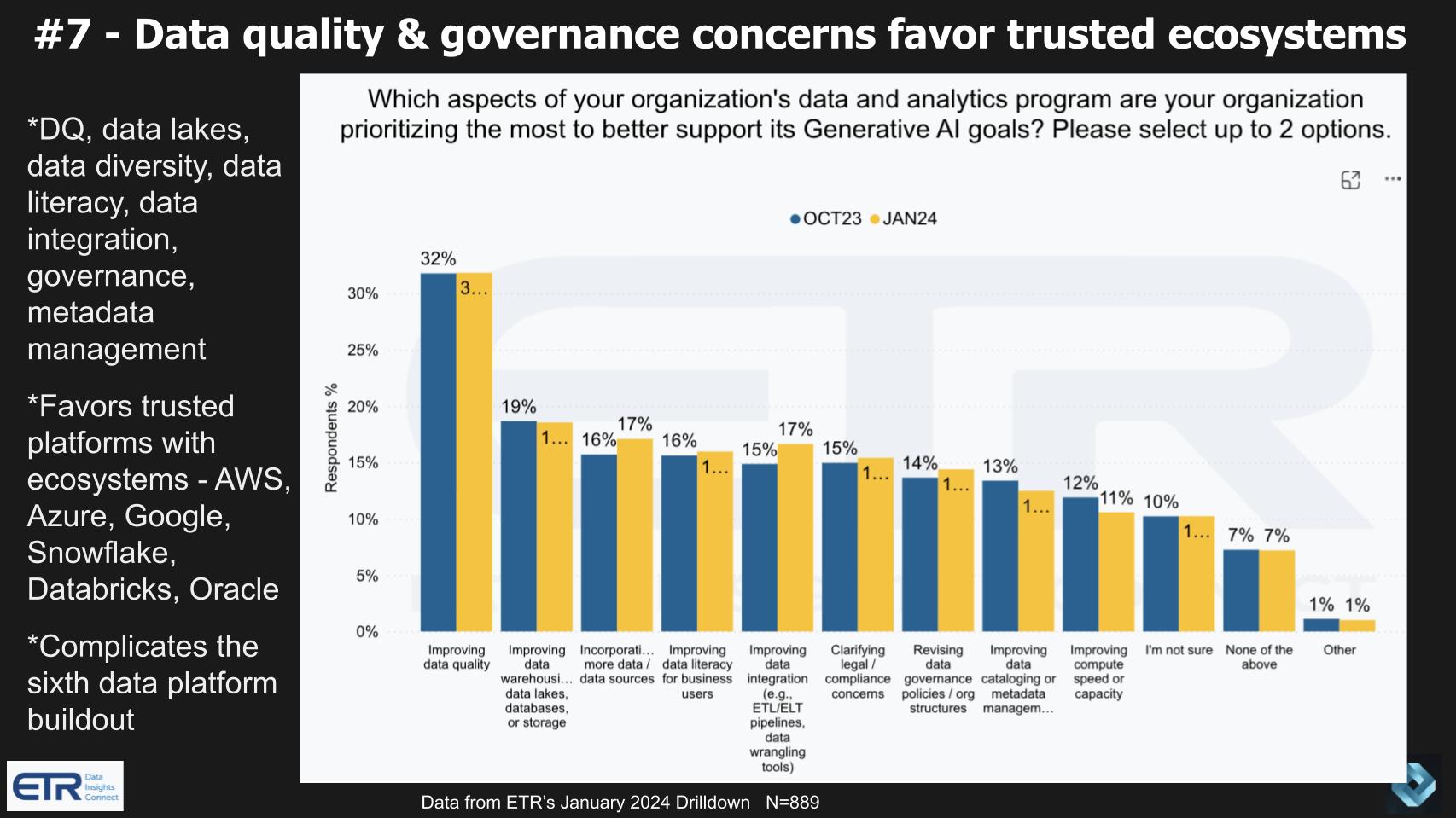

#7 – Data Quality & Governance Concerns Favor Trusted Ecosystems

Our analysis predicts a significant shift towards prioritizing data quality and governance, which in turn favors established and trusted technology ecosystems. This shift is driven by the need to support Gen AI goals effectively. Key data points from an ETR drilldown survey are shown in the graphic below and highlight the data challenges faced by practitioners.

Relevant points on this prediction include:

- The prioritization of data quality, data lakes, diversity, literacy, integrations, and governance is critical for organizations aiming to harness Gen AI’s full potential.

- We believe this trend distinctly benefits trusted platforms with robust ecosystems, such as AWS, Azure, Google Cloud, Snowflake, Databricks, and established data players like Oracle. These platforms are recognized for their ability to manage complex data needs. Snowflake and Databricks in particular are infusing AI into today’s modern data stack and winning in the market with continued momentum in spending velocity and share gains.

- AWS and Azure are leading in this space, but Google Cloud also plays a significant role in both AI and data innovation. Oracle, with its transactional data capabilities, and IBM are notable for their potential in managing diverse data types. IBM with Watson 2.0 appears to be on the right track and Oracle’s full stack AI offerings from infrastructure to apps is a winning formula in our view.

- The focus on data quality is paramount. The principle of “garbage in, garbage out” emphasizes the importance of high-quality data for successful AI applications.

- The focus on ecosystems, including effective ETL processes and data pipelines, is crucial for translating data into actionable insights for business users.

- Our research indicates that data quality is a primary concern, outweighing other aspects in data and analytics programs as per current survey data.

In summary, for 2024 our prediction is that the demand for high data quality and robust governance will increasingly favor established technology platforms with comprehensive ecosystems. These platforms are likely to become even more pivotal in supporting organizations’ Gen AI initiatives due to their advanced capabilities in handling complex data types and ensuring data integrity.

Followers of Breaking Analysis have seen our work on the sixth data platform. While we believe the future of data platforms will shift emphasis to real time, unified data sources, the challenges cited above, especially related to governance will push its emergence to the second half of this decade.

#8 – Renewed Importance of (New) Data Literacy and Skills – “Yes Code”

Our analysis highlights the growing importance of new data literacy and skills in the continued application of generative AI (Gen AI) and business-user-friendly technologies like low-code/no-code applications, RPA, and generative UI tools. The survey results and our key points below underscore the data challenges organizations face in achieving their Gen AI goals.

Note: ETR’s Daren Brabham provided this prediction.

GenAI – as well as more business-user-friendly self-service capabilities like low-code/no-code, RPA & “Gen UI tools” (code generated from screen grabs) – brings with it new sets of skills that will be in demand in the market. Watch for a rise in offerings from IT training companies like Pluralsight/Skillsoft/LinkedIn Learning/Coursera/etc. that focus on things like “GenAI prompt management” or “ethical/responsible use of GenAI,” etc. We’ll start to see new roles like “GenAI Prompt Engineer” in the market. As more orgs let GenAI proliferate, there will need to be more data literacy training in general across the workforce so that the outputs from GenAI are used properly and GenAI ‘hallucinations’ are seen with a critical eye…or minimized.

Key Elements of our Research and Predictions

- The rise of Gen AI and user-friendly tools like low-code/no-code applications is creating a demand for new skill sets in the market. This includes proficiency in prompt management, ethical use of Gen AI, and understanding generative UI principles.

- We anticipate a surge in educational offerings from IT training companies such as Pluralsight, Skillsoft, LinkedIn Learning, and Coursera. These offerings will likely focus on areas pertinent to Gen AI, including prompt engineering and responsible AI usage.

- We predict the emergence of new roles such as “Gen AI prompt engineers,” reflecting the growing need for specialized skills in optimizing Gen AI outputs.

- There will be an increased need for general data literacy training across the workforce. This training is crucial to ensure that Gen AI outputs are utilized effectively and to minimize the risk of Gen AI hallucinations or misleading outputs.

- The concept of “yes code,” which combines Gen AI with front-end tools to create generative UI, is gaining traction. This approach underscores the evolving relationship between AI and user interface design.

- We are already observing Gen AI prompts being listed as a skillset in job descriptions and resumes, indicating a swift adaptation to these new technologies in the job market.

- Non-technical business users are increasingly required to become data literate to remain relevant in their roles, regardless of age or prior experience.

- The majority of AI budgets are now originating from business departments, not traditional IT sectors, signifying a broader shift in how AI is integrated and utilized across various business functions.

In conclusion, our prediction is that the demand for new data literacy and skills related to Gen AI and associated technologies will continue to grow. This trend will likely lead to an expansion of educational offerings, the emergence of new job roles, and a greater emphasis on data literacy across all levels of the workforce. As AI becomes more embedded in business processes, staying abreast of these evolving skillsets will be crucial for professionals across various industries.

Yes Code: Generative AI + Frontend = Generative UI. [In 2024], we’ll see more “Generative UI” tools that enable instant creation of UI code from screenshots, drawing, voice, or prompts. Critically, the tools that embrace established industry tools (like React) for their outputs, will lower the barrier for shipping generated code in real product use cases. -Lee Robinson, VP of Product, Vercel

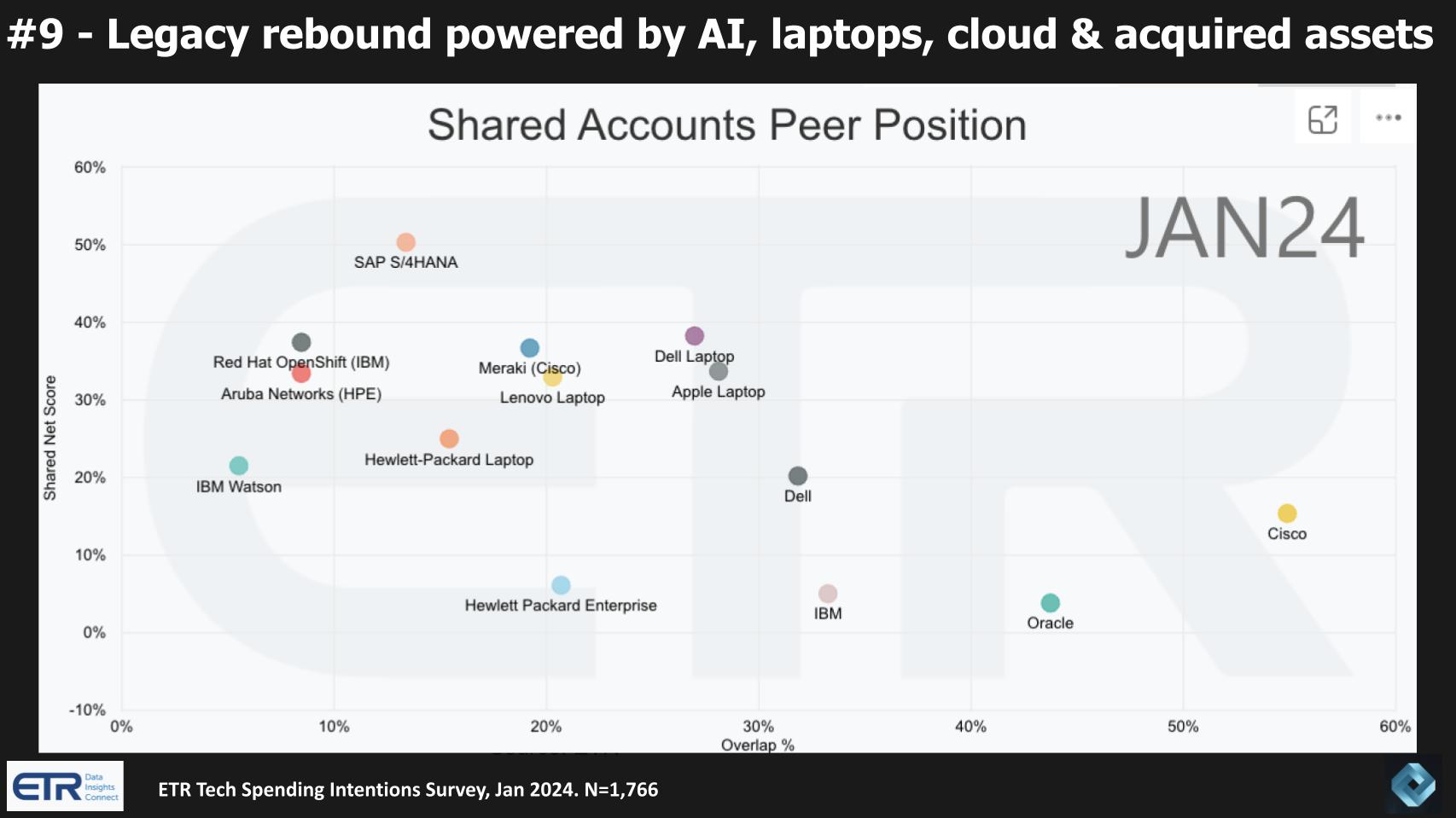

#9 – Legacy Rebound Powered by AI, Laptops, Cloud & Acquired assets

We’re seeing a resurgence of legacy tech companies, powered by a refresh cycle that will support on-prem AI workloads. As well, cloud advancements and strategic acquisitions have enabled these companies to provide “good enough” operating experiences that have stopped the massive bleeding off of workloads to the public cloud. This trend, as reflected in recent data, suggests several key developments that we’ll highlight below. Notably, not all companies are in a position to take advantage of these trends and we believe the leaders in key sectors will benefit to a greater degree.

The following key points are relevant:

- We expect a “legacy rebound” in companies such as Cisco, Oracle, IBM, Dell and HPE, driven by innovative uses of AI and cloud technologies. In the case of Dell, a PC rebound will be incrementally beneficial as well.

- Notably, IBM, with watsonx and its Red Hat acquisition, Oracle it’s cloud and other significant R&D investments are poised to benefit form the legacy tech refresh.

- The trend is further supported by a renewed focus on laptops, with a refresh cycle anticipated, especially for companies like Apple and Dell. This aligns with Intel’s projections for growth in PC sales, despite that company’s troubles stemming from its cash needs to fight a multi-front war.

- We believe that these legacy companies are not only reclaiming their position in the market but also actively investing in and adapting to current technological trends, unlike predecessors of the 80’s and 90’s that failed to adapt.

- The ETR survey data indicates a broad improvement in spending trajectories for these legacy companies, spanning cloud, data and hardware sectors.

- We predict that the economic downturn and budget constraints have inadvertently given these companies a “second life,” allowing them time to enhance their offerings and close the experience gap with cloud providers.

- The concept of hybrid cloud is gaining traction, with companies like IBM in particular but also HPE, Dell and VMware asserting their presence in this domain.

- In addition, we expect a comprehensive hardware refresh cycle across servers, storage and networks, indicating a robust period for hardware renewals.

In summary, our analysis suggests that legacy companies are experiencing a significant comeback, fueled by AI, cloud innovations, and a focus on hardware. This resurgence is not merely a return to form but an evolution, with these companies actively embracing new technologies and market dynamics. As a result, they are well-positioned to compete in the current technology landscape, making them better positioned this decade to compete with the dominance of cloud-native players.

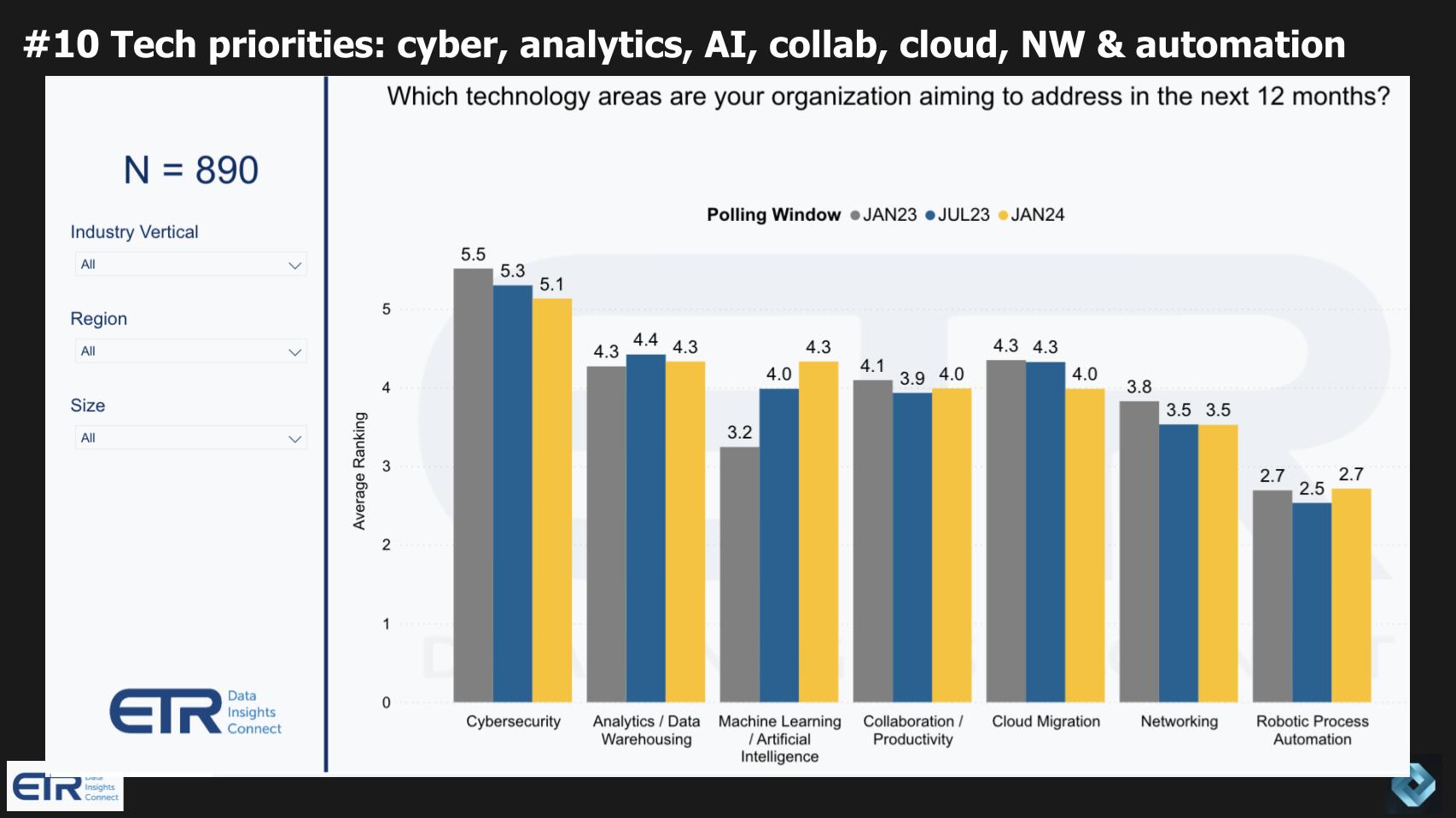

#10 Tech Priorities: Cyber, Analytics, AI, Collab, Cloud, NW & Automation

This recent analysis shown below of technology priorities highlights that cybersecurity, analytics, AI, collaboration, cloud, networking and automation remain at the forefront of tech investment and innovation.

Key observations from the data and our predictions include:

- Cybersecurity consistently ranks as the top priority across industries and geographies. Despite a slight decrease, it remains the top focus area.

- The importance of analytics and data warehousing is prominent, emphasizing that effective data management is foundational to leveraging AI technologies.

- Collaboration tools, which gained prominence during the pandemic, continue to be vital for organizational operations to support hybrid work, which has become the dominant model for organizations.

- While cloud adoption has seen slowing growth post-pandemic, cloud-based innovation remains a significant driver of technological advancement. The versatility and rich ecosystems offered by cloud providers continues to power new value.

- Networking is gaining importance in AI environments, evolving as a new bottleneck to address.

- Robotic Process Automation (RPA) is maintaining its relevance and showing signs of increased adoption and is reforming as an end-to-end enterprise capability often described as “intelligent automation.”

- A notable shift in cloud strategies is expected, with a decrease in the urgency of cloud migration. Many organizations are moving towards a hybrid model, combining private cloud assets with public cloud services.

- The data suggests a slowdown in the anticipated pace of cloud workload migration. The expectation of achieving 60-70% cloud workloads is progressing more slowly than initially thought.

- That said, the cloud continues to be the epicenter for innovation and new workload creation, particularly driven by generative AI technologies.

- The digital transformation journey is far from over, indicating a long-term, sustained investment in cloud technologies and digital initiatives.

In summary, our prediction suggests that cybersecurity, analytics, AI, and cloud will remain top tech priorities. However the nature of cloud adoption is evolving. The focus is shifting from mere migration (lift and shift) to innovation and new workload creation in the cloud, influenced significantly by developments in generative AI. This trend signals a maturing market where established technologies are being leveraged for new, innovative applications.

How do you see 2024 shaping up?

What’s your outlook for tech spending and which technologies will provide the greatest opportunities and disruptive threats?

Let us know.

Keep in Touch

Thanks to Alex Myerson and Ken Shifman on production, podcasts and media workflows for Breaking Analysis. Special thanks to Kristen Martin and Cheryl Knight who help us keep our community informed and get the word out. And to Rob Hof, our EiC at SiliconANGLE.

Remember we publish each week on Wikibon and SiliconANGLE. These episodes are all available as podcasts wherever you listen.

Email david.vellante@siliconangle.com | DM @dvellante on Twitter | Comment on our LinkedIn posts.

Also, check out this ETR Tutorial we created, which explains the spending methodology in more detail.

Watch the full video analysis:

Note: ETR is a separate company from theCUBE Research and SiliconANGLE. If you would like to cite or republish any of the company’s data, or inquire about its services, please contact ETR at legal@etr.ai or research@siliconangle.com.

All statements made regarding companies or securities are strictly beliefs, points of view and opinions held by SiliconANGLE Media, Enterprise Technology Research, other guests on theCUBE and guest writers. Such statements are not recommendations by these individuals to buy, sell or hold any security. The content presented does not constitute investment advice and should not be used as the basis for any investment decision. You and only you are responsible for your investment decisions.

Disclosure: Many of the companies cited in Breaking Analysis are sponsors of theCUBE and/or clients of Wikibon. None of these firms or other companies have any editorial control over or advanced viewing of what’s published in Breaking Analysis.