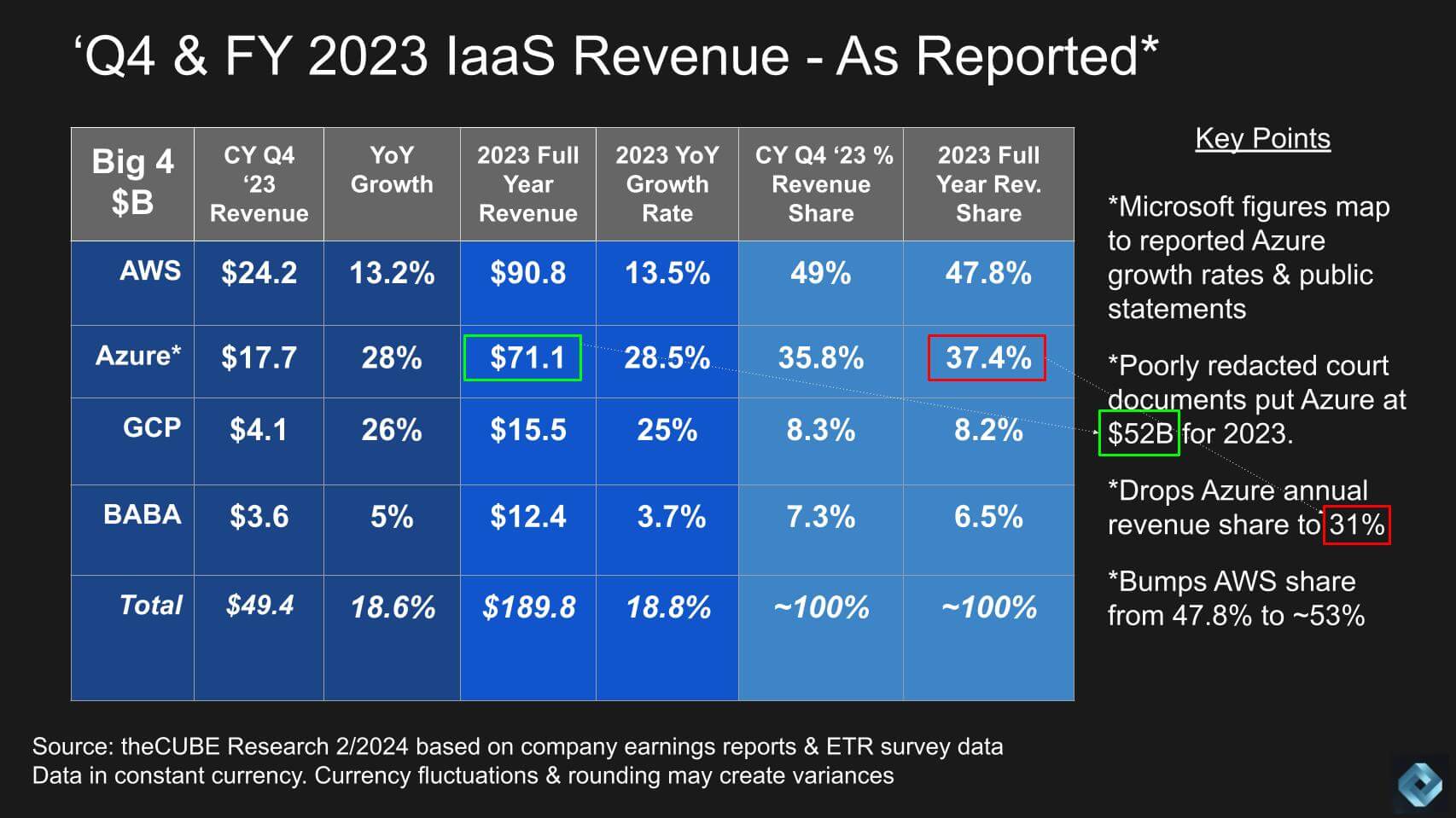

The past twenty-four months have seen cloud spending face dual headwinds of macroeconomics and the ability to dial down resources as needed – i.e. cloud optimization. Nonetheless, the big four hyperscalers clocked in between $170 – $190B in IaaS and PaaS revenue last year depending on how you factor the leaked court documents suggesting Azure is much smaller than previously believed. Regardless, hyperscaler growth continued to outpace almost all markets, accelerating between 18-19% in revenue terms last year, despite their enormous size.

As we progress into 2024, IT decision makers are cautiously optimistic about spending levels, especially for the second half. All hyperscalers report that cloud optimization is slowing although pockets of cloud cost cutting remain. While AI gets all the headlines, its contribution to revenue is still a small fraction of the overall spending pie. For example, we estimate that Microsoft’s AI services accounted for around $800M this past quarter. But the trajectory for AI services and the potential uplift looks promising for all four hyperscalers. We think collectively the generative AI uplift in cloud will surpass $10B this year.

In this Breaking Analysis we update you on our latest hyperscale cloud spending and marketshare data. We’ll analyze the ETR survey data on cloud optimization, assess the Gen AI updraft for the big 3 US cloud players and look at some of the industry trend data on cloud spend by platform.

Spending Expectations Trending Positive

First let’s review the macro spending climate which is looking positive but still uncertain.

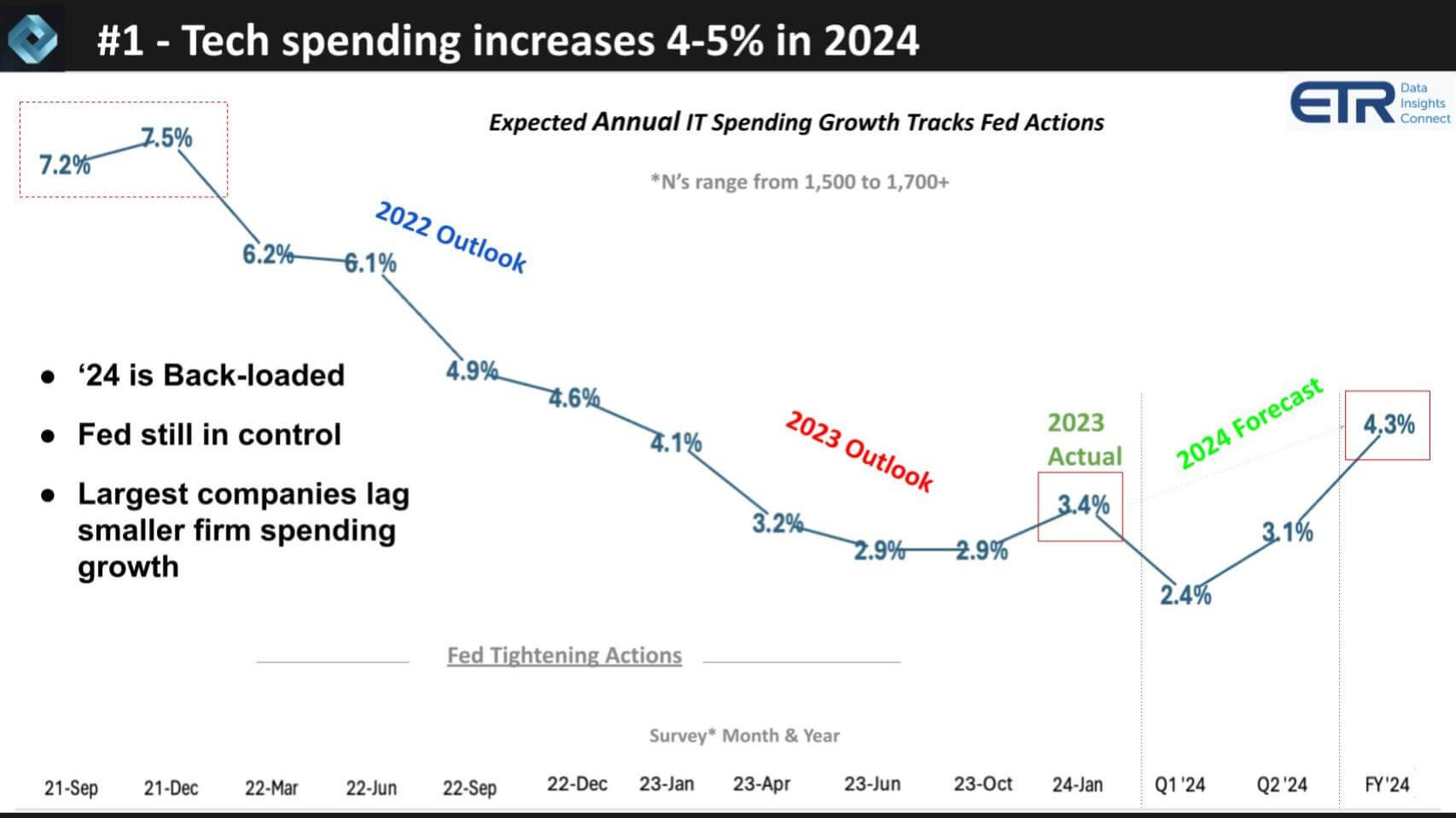

The inflation data came in this past week hotter than expected and sent the stock market reeling. The interest rate sensitive Nasdaq continues to try and climb out of Tuesday’s lows but ended the week on a down note. The above chart is from our 2024 predictions post shows just how tied spending expectations are to the economic data. As you can see back in late 2021, IT decision makers were expecting a whopping 7.5% spending increase for the year. Those annual spend expectations continued to contract as the Fed tightened; and forecasts bottomed at 2.9% in the October survey. And the numbers came in at 3.4% for the year 2023, above expectations in October.

The other good news is ITDMs expect 2024 to come in at around 4.3% growth. But the caution is it’s very much back loaded with Q1 and Q2 spending expected to increase 2.4% and 3.1% respectively. And we think the reality is companies are staying cautious because they don’t know precisely what’s going to happen. Uncertain visibility remains the case for most CFOs hence the back loaded expectations.

AI Funding Constricts Budgets

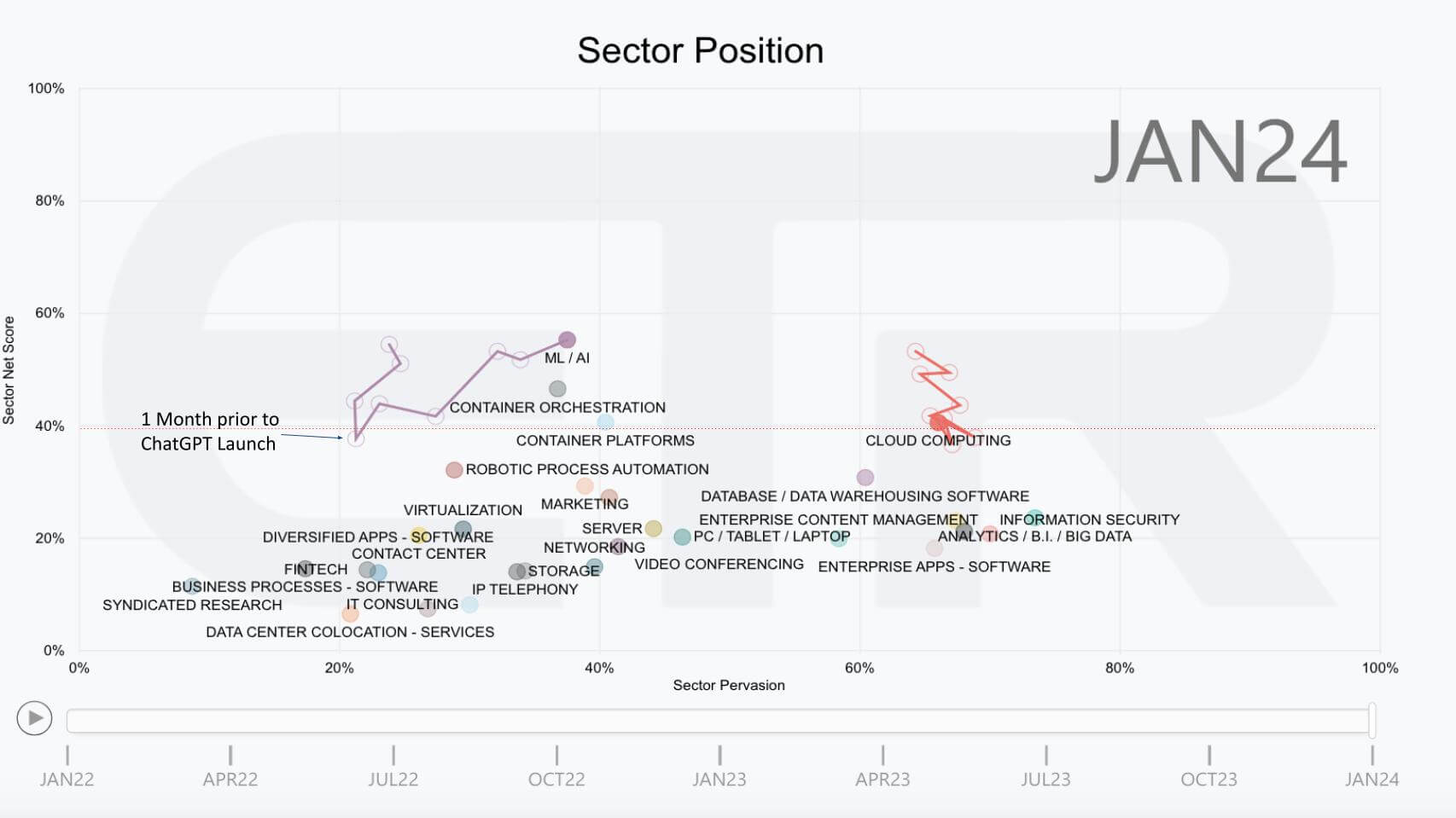

The sector spending patterns indicate that AI is stealing from other sectors. This chart shows the distribution of responses from more than 1,700 ITDMs in the latest ETR spending survey. The data on the vertical axis represents Net Score or spending momentum and the horizontal axis represents perversion of a sector in the data set which is a proxy for relative account penetration for each sector. The red line at 40% indicates a highly elevated spending level.

Cloud Rebounds

Focusing on cloud computing, we saw a steady deceleration in cloud spending momentum relative to Jan 2022, when Cloud Computing was well above the 40% mark. That deceleration trend reversed in the latest survey bringing the sector back above the 40% line. This is consistent with what we saw in the revenue data which we’ll review in a moment.

AI Continues to “Steal” Budget

The other key takeaway from the data is AI has gained notable momentum on both dimensions since the announcement of ChatGPT. Survey data indicates that approximately 40% of new AI projects are being funded by taking funds from other budgets. Most sectors have seen contracting Net Scores on the vertical axis over the past several quarters and AI is the clear exception.

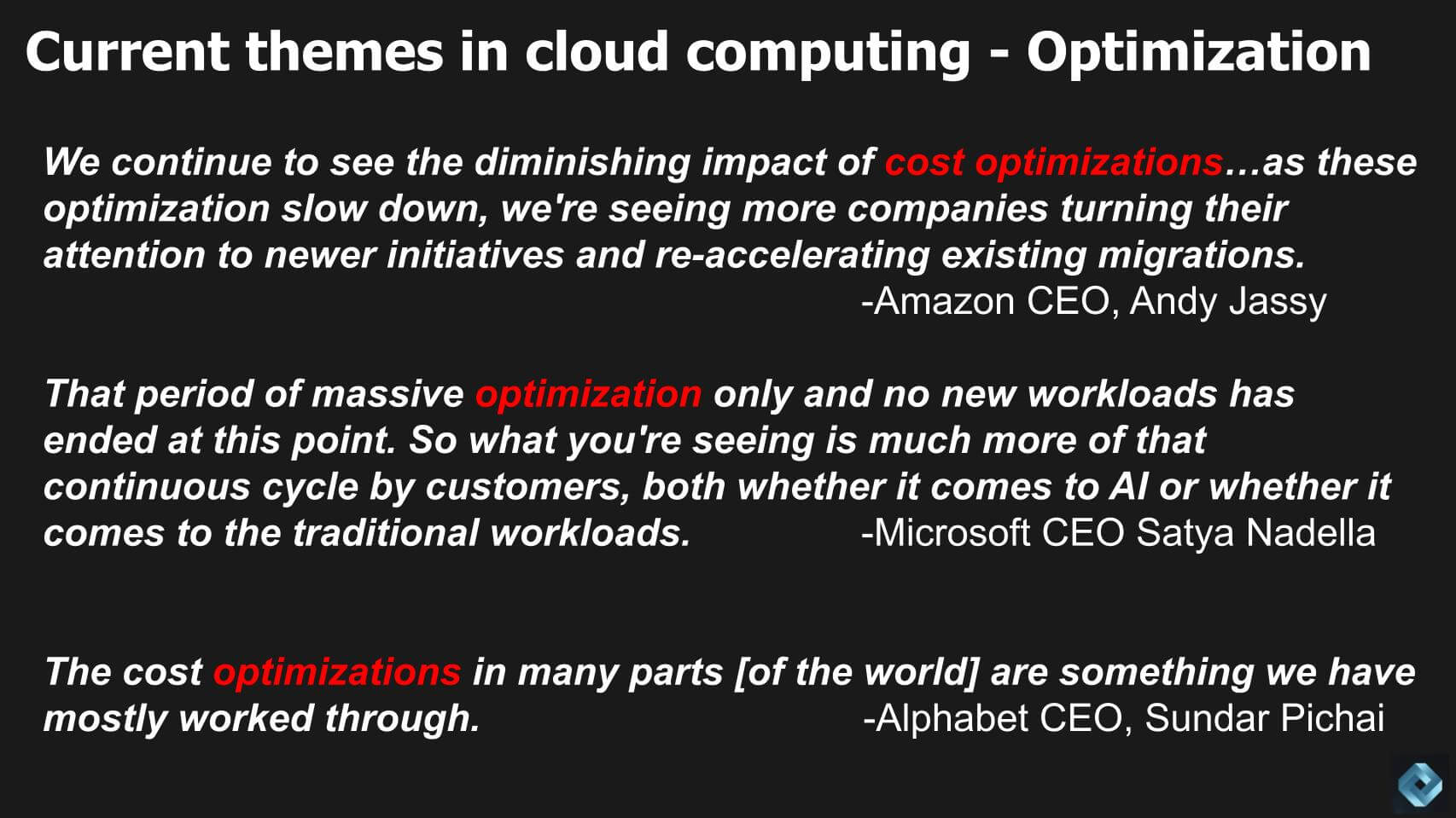

All Cloud CEOs Report Slowing Optimization

So where are we today and what is the impact of Cloud Optimization going forward?

Here are comments from the leaders of the big 3 US cloud vendors.

We continue to see the diminishing impact of cost optimizations…as these optimizations slow down, we’re seeing more companies turning their attention to newer initiatives and re-accelerating existing migrations. -Amazon CEO, Andy Jassy

That period of massive optimization only and no new workloads has ended at this point. So what you’re seeing is much more of that continuous cycle by customers, both whether it comes to AI or whether it comes to the traditional workloads. -Microsoft CEO Satya Nadella

The cost optimizations in many parts [of the world] are something we have mostly worked through. -Alphabet CEO, Sundar Pichai

Survey Data Confirms CEO Statements with a Caution

Let’s look at what the survey data says about cloud optimization.

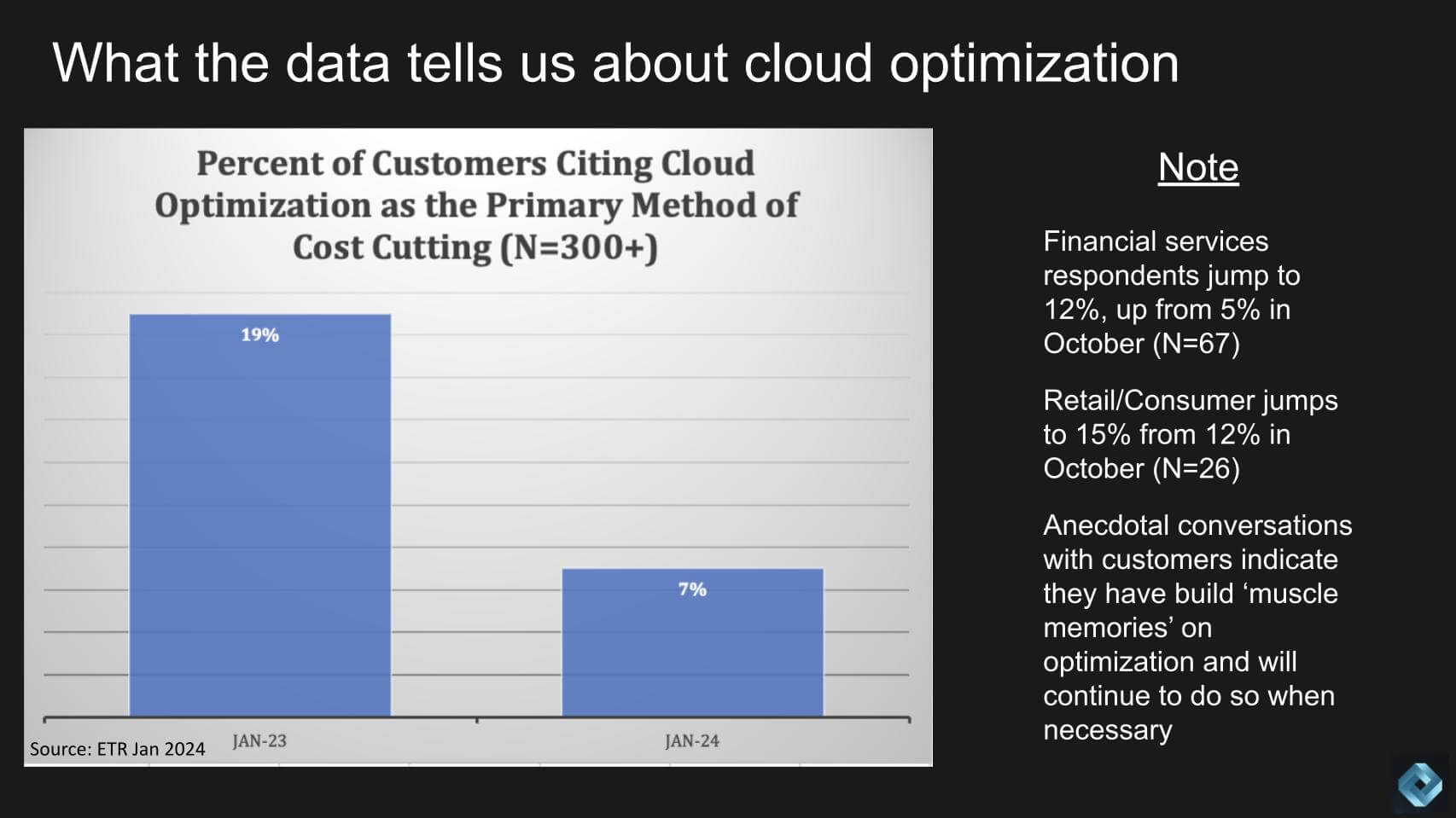

The chart above shows the percent of customers indicating that cloud optimization is the primary cost cutting method. This figure has reduced dramatically from one year ago to 7% down from 19% of customers. However in the important financial services sector we continue to see customers citing cloud optimization as a primary method (12%). That’s up from 5% in the October survey. Fifteen percent of retail customers say it’s their primary method but that could be related to winding down holiday capacity increases.

The caution is further underscored by the anecdotal comment shown above which says that customers became adept at dialing down capacity and optimizing cloud spend. They’ve developed “muscle memory” and while they’re turning more attention to innovation, optimization is still an important tool in the kit.

Signs of Gen AI Uplift but Still Relatively Small

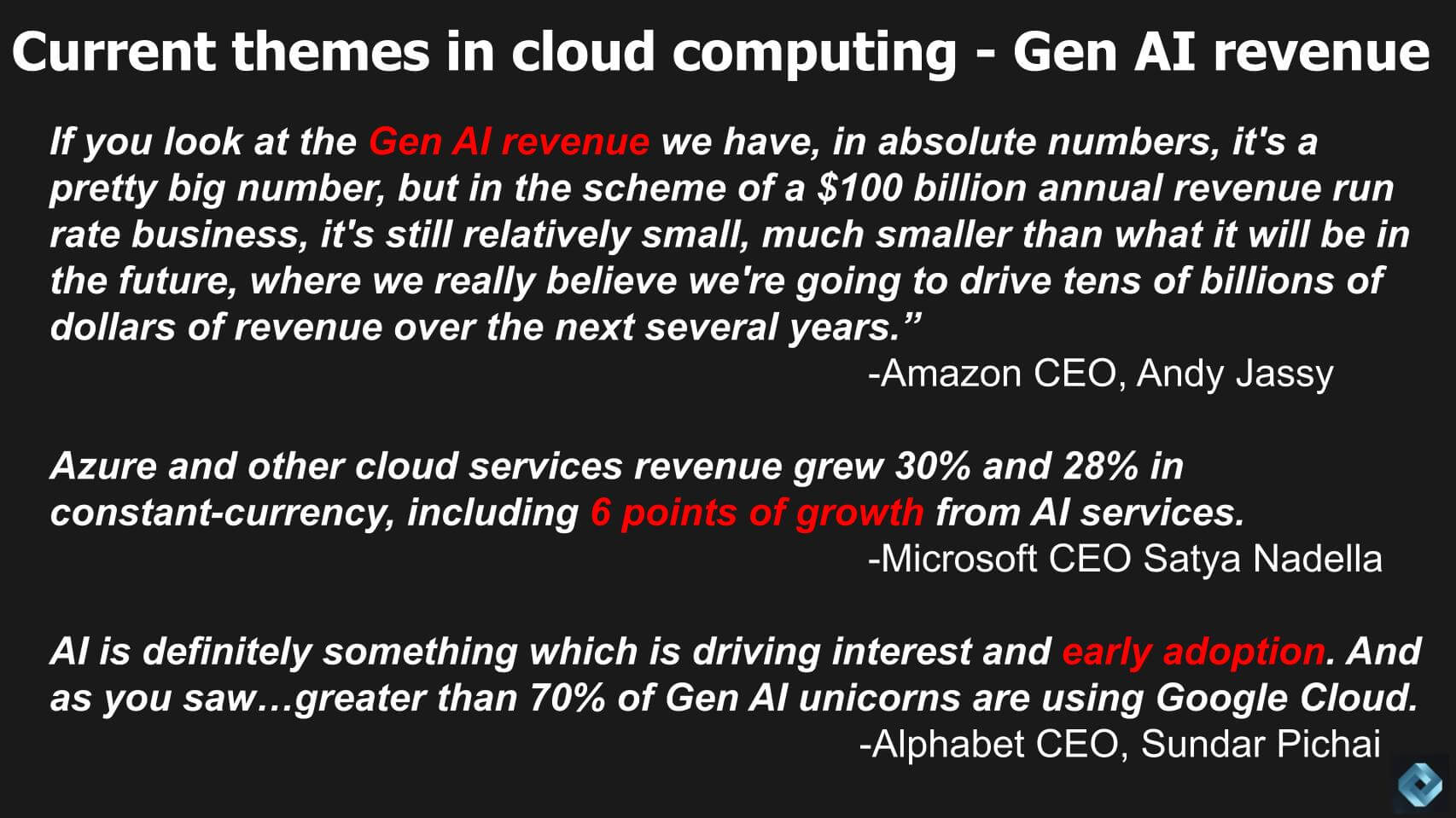

Of course the other big theme we listen for in earnings calls is generative AI revenue.

Here are some comments from the Big 3 worth reviewing.

If you look at the Gen AI revenue we have, in absolute numbers, it’s a pretty big number, but in the scheme of a $100 billion annual revenue run rate business, it’s still relatively small, much smaller than what it will be in the future, where we really believe we’re going to drive tens of billions of dollars of revenue over the next several years.” -Amazon CEO, Andy Jassy

Azure and other cloud services revenue grew 30% and 28% in constant-currency, including 6 points of growth from AI services. -Microsoft CEO Satya Nadella

AI is definitely something which is driving interest and early adoption. And as you saw…greater than 70% of Gen AI unicorns are using Google Cloud. -Alphabet CEO, Sundar Pichai

Hyperscale Cloud Growing Nearly 20% Annually at a $200B Run Rate

Let’s look at the market data.

Note: A previous version of this graphic incorrectly had 2024 instead of 2023 in the headings.

Above we show data for the Big 4 hyperscalers both quarterly and full year. For the fourth calendar quarter, these companies generated nearly $50B in revenue. AWS and GCP growth accelerated in the quarter and Azure was flat.

Other key trends:

- AWS is now just about a $100B revenue run rate business, an amazing figure especially given its growth rate accelerated last quarter.

- Azure’s flat revenue growth for the quarter is intriguing given the six points of tailwind from AI services. This suggests that without AI, Azure revenue would have grown 22% in constant currency, a sign of decelerating growth for underlying Azure cloud services.

- Further unpacking Azure…If you go by the public statements of Azure growth and Azure comprising 50% of Microsoft’s $110B intelligent cloud business last fiscal year, you can get to $71B in 2023. But, if you factor in the poorly redacted court docs and try to map public statements to those figures, Azure on an apples-to-apples with AWS’ business comes in at $52B. Our hypothesis is that Microsoft agreed with the court in the Activision case to define Azure in a manner more closely with AWS’ business. Perhaps excluding certain security and other line items and maybe excluding certain legacy on-prem Azure Stack revenue.

- If you adjust Azure for the court leak, it takes Azure market share of the Big 4 from 37% down to 31% and bumps AWS up from 48% to 53%.

If you adjust Azure revenue for the court leak, it takes Azure market share of the Big 4 from 37% down to 31% and bumps AWS up from 48% to 53%.

Nuanced we know but we continue to dig into this issue to get to the bottom of the story.

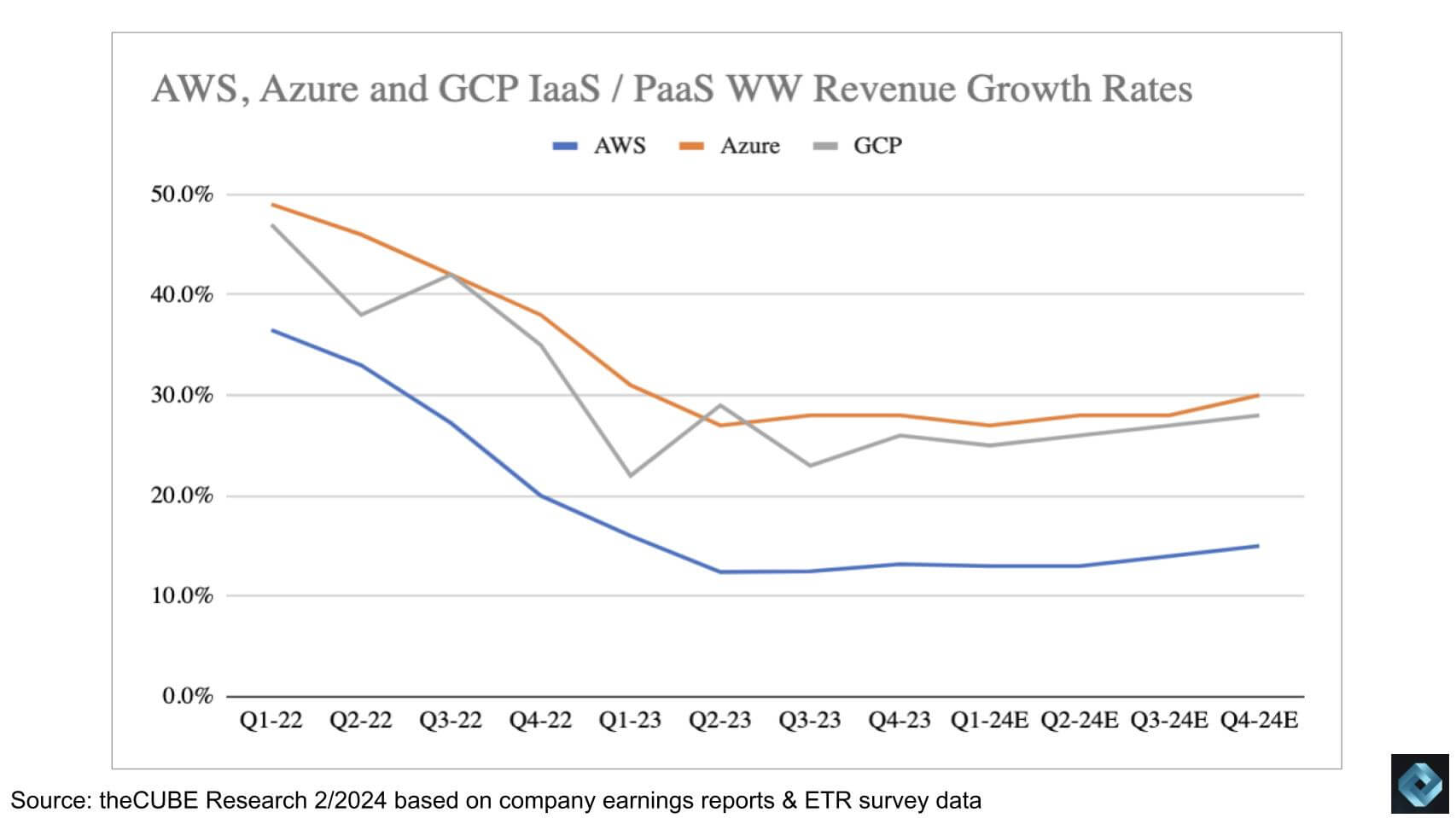

Decelerating Cloud Growth Reverses

Below is a graphic of the growth rates for the Big 3 US hyperscalers.

AWS is the bottom line in blue, GCP is the gray and Azure is the orange. Note AWS reversed the decelerating growth rate trend and actually grew sequentially to 13.2% from 12.5% last quarter. That, for a $100B run rate company is quite a feat. Azure was flat despite the six points of tailwind from AI and GCP grew by our estimates. But for its size and maturity, Google Cloud should be growing much faster in our view. That’s the penalty you pay for being number three.

Our working assumptions for 2024 basically follow the macro trends with growth holding and maybe softening a bit in the first half and picking up in H2, bolstered by an ever accelerating contribution from AI.

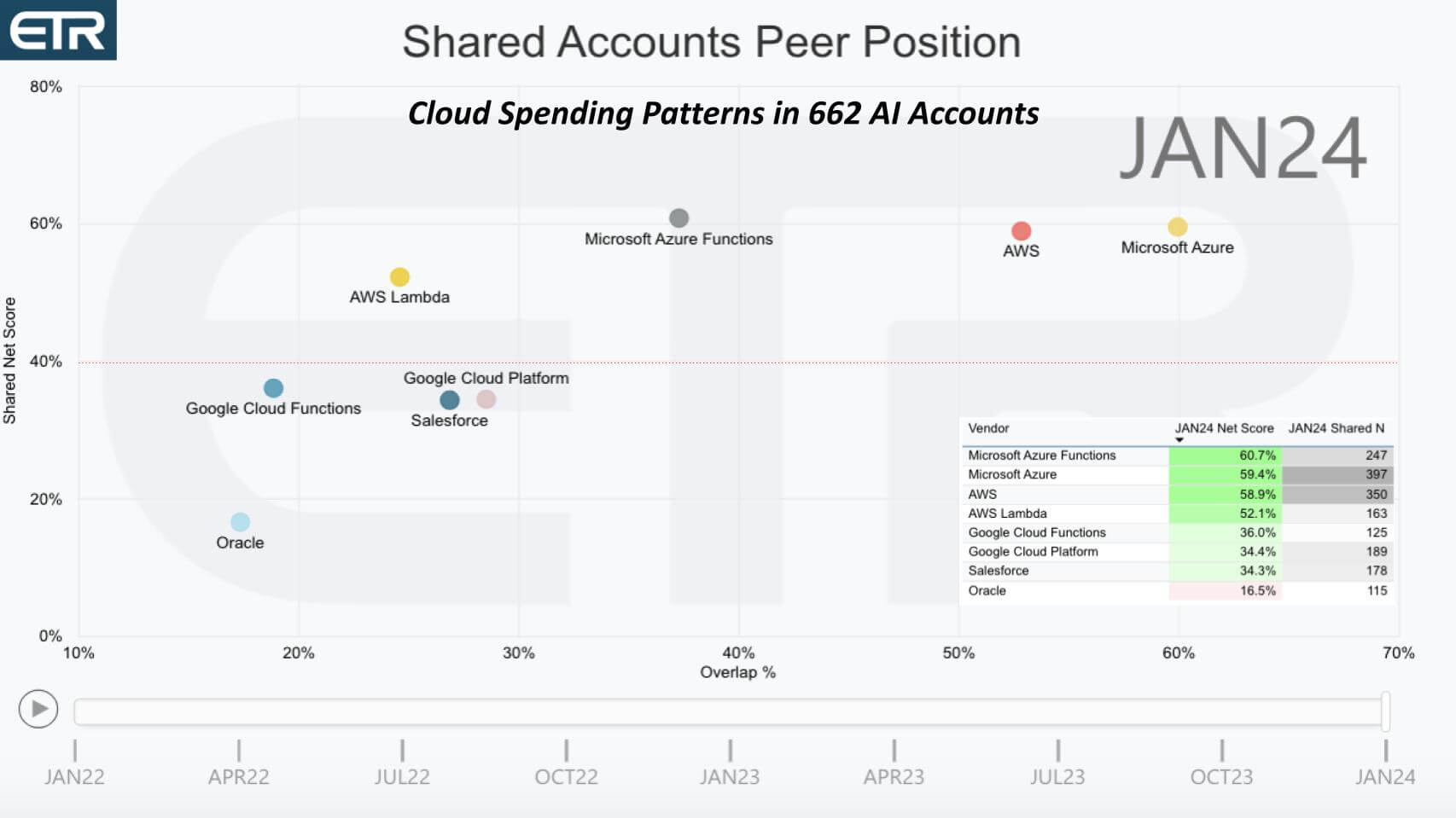

Plotting Hyperscalers in AI Accounts

Speaking of AI let’s look at the spending patterns in 662 AI accounts from the ETR data. What we’re doing here is filtering the 1,700+ respondents on AI accounts and identifying the spending momentum and presence of each cloud platform in the data.

The chart above shows Net Score or spending velocity on the vertical axis and penetration within the 662 AI accounts for each platform on the horizontal axis. The table insert shows how the data are plotted on the graphic. The key points are:

- AWS and Azure are well ahead of the pack in customer spending momentum and are the only two firms above the 40% mark.

- Google and Salesforce are close to that 40% metrics.

- Oracle is respectable with a 17% Net Score but well behind the leaders.

Note: We filtered this data on platforms with N at or greater than 100 so it doesn’t show, for example, IBM cloud or the on-prem / hybrid players.

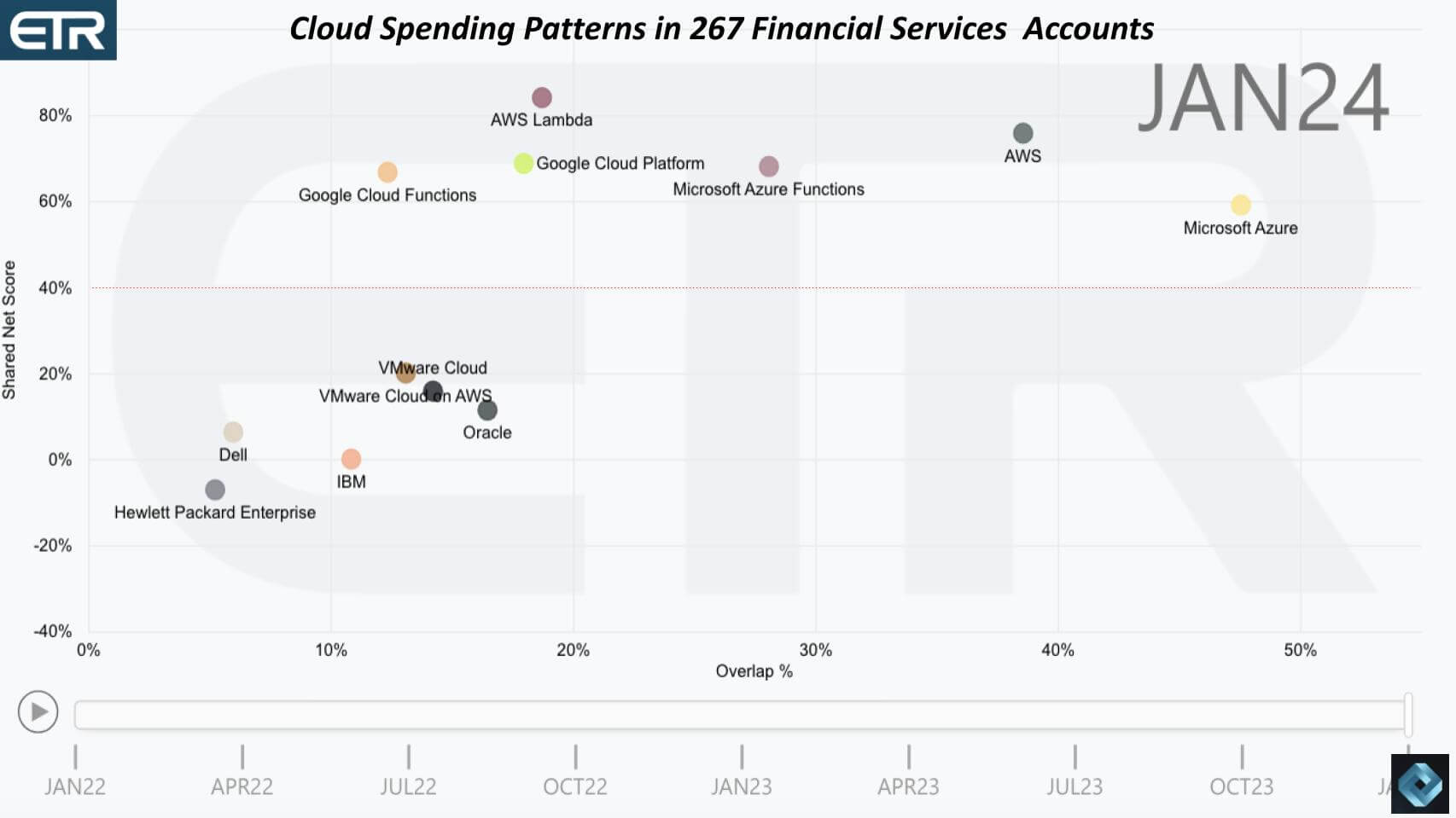

AWS Momentum in Financial Services Surpasses Azure

This next chart filters the data on 267 financial services accounts in the data set.

The key points that stand out are:

- AWS take the lead in Net Score in this sector. FS is a mainstay for Amazon.

- Google also does well as does Microsoft.

- In this cut we’ve not filtered the N and you can see the other players that hit the chart. Despite talk of cloud repatriation, the on-premises players don’t have nearly the customer spend momentum as do the hyperscaler cloud players.

The adoption of cloud in financial services is quite notable given the early cloud backlash from the financial industry. Look how far above the 40% line all the US hyperscalers sit.

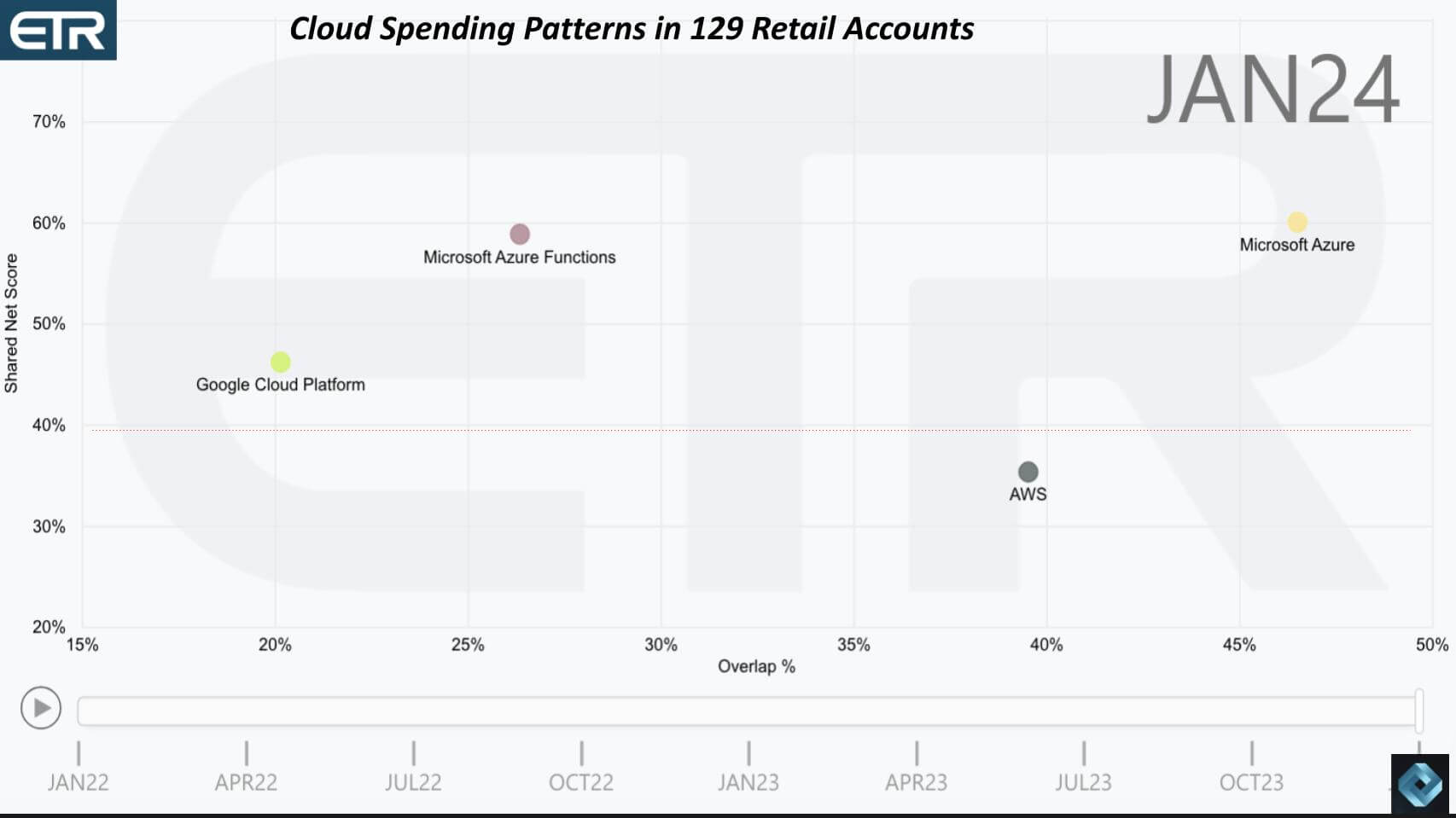

Different Story in the Retail Sector

The last vertical we’ll dig into is retail which shows a far different picture, especially for AWS with retail rivals like Walmart leveraging other clouds.

Both Azure and GCP show higher Net Scores than AWS in this picture but AWS still has a big presence in the sector. But it’s below the 40% mark while the other two are above.

Assumptions for 2024

So that’s a quick run through of the latest data. There’s so much more that we’re discussing with our private clients but if you have specific questions let us know and we’ll try to help.

Let’s wrap with some final thoughts.

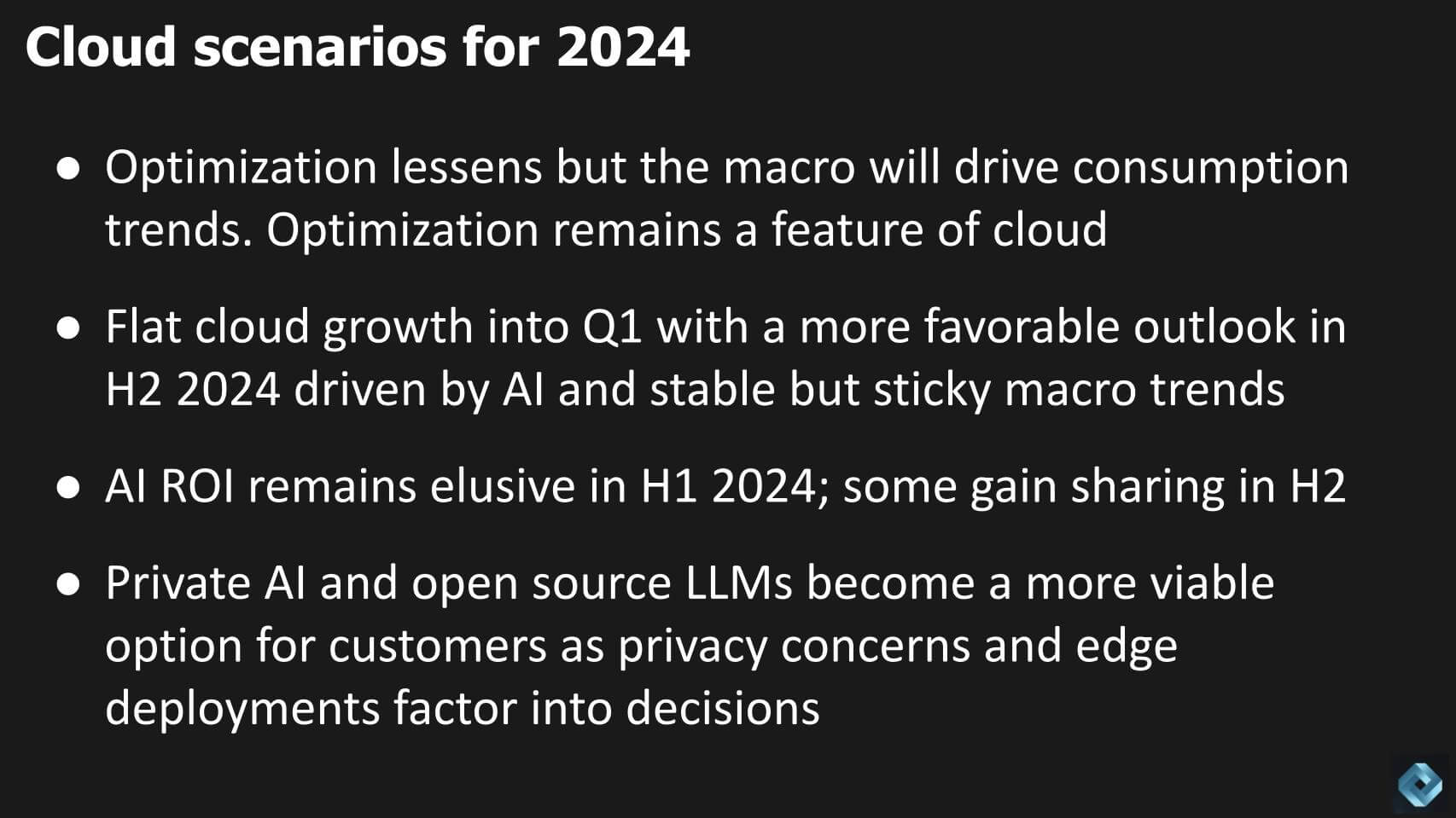

- While cloud optimization is less of a factor, we think the macro will still drive consumption trends. Optimization remains a feature of cloud and cuts both ways – what goes up can still come down – that’s not a bug it’s a benefit but won’t always accrue to the cloud vendor. That’s ok – they’re doing just fine :-)

- We’re looking for flattish cloud growth into Q1 with a more favorable outlook in H2 2024 driven by AI and stable but sticky macro trends…meaning the inflation data was no surprise and we don’t expect the fed to rescue the market any time soon. It will be very cautious.

- So that means AI ROI will have to be the tailwind but we think ROI remains elusive in H1 2024; some gain sharing will kick in H2 but this idea that AI is so easy we think is illusory. It’s like any new tech…it takes time to adopt and figure out the use cases and specifically in this case to govern properly.

- The other theme you’ll hear this year is so-called Private AI – i.e. the idea that domain specific smaller LLMs will be deployed on prem. As well, open source LLMs become a more viable option for customers as privacy concerns and edge deployments factor into decision making.

Open source models like Llama could really commoditize the big language models so the key is how the developers of such models deploy them. Microsoft’s success with GitHub Copilots could be repeated with productivity software but early reports are using copilots for Powerpoint and Excel is still clunky. And Google has a lot to lose with 10 blue links on every page with its auction model optimizing revenue. That’s perhaps not as relevant to the cloud but it’s an example where AWS and Microsoft don’t have to worry about protecting a golden search goose. In fact Amazon Rufus is really intriguing because if it’s effective, I won’t have to go to Google to research a purchase as much.

The market is really uncertain right now in the short term. Longer term the picture is bright and like most of these waves is will likely exceed expectations.

In the near term expect some disappointments along the way.