One Year Into the Federation Model

In April 2013, EMC and VMware launched Pivotal and created a federation of its businesses. A year has provided more clarity as to how these businesses will not only collaborate, but also if they are to be successful, potentially compete and create disruption in the marketplace.

The EVP (EMC, VMware, Pivotal) messaging and joint solutions were prominent during EMC World 2014. While solutions can span between the companies and employees do move inside the federation (it is fair to look at the executive team as a large and deep bench since VMware CEO Pat Gelsinger moved from EMC and Pivotal CEO Paul Maritz has also held roles at EMC and the top job at VMware), those that call for changes such as VMware to reunify with EMCdo not understand the strategy.

The Federation Companies

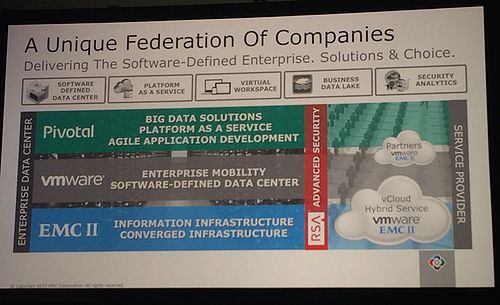

There is now a website for the EMC Federation – it calls out four companies with equal billing:

- EMC II: EMC Information Infrastructure and Converged Infrastructure (which includes EMC’s joint venture with Cisco, VCE, which is now on a $1.8B revenue run rate). See video interviews from EMC World 2014 with EMC II CEO David Goulden and VCE CEO Praveen Akkiraju

- Pivotal: Big Data Solutions, Platform-as-a-Service (PaaS), Rapid Application Development. See video interviews about Federation Big Data Solutions and a Big Data customer case study.

- VMware: Mobility and Software-Defined Data Center. vCloud Hybrid Service (vCHS) is now a “federation asset”, which means that both EMC and VMware sales forces and channels offer the solution, plus Pivotal offers services on top of the platform. See video interviews from EMC World 2014 with VMware CEO Pat Gelsinger and VMware VP of vCHS Mathew Lodge.

- RSA: Advanced Security.

Basically, EMC2 (ticker: EMC), led by Chairman and CEO Joe Tucci, sits at the helm and the three CEOs – Goulden for EMC II, which is the products, services and employees that are part of the original EMC; Gelsinger for VMware (ticker: VMW), whose majority stockholder is EMC; and Maritz for Pivotal, which is owned by EMC (62%), VMware (28%) and GE (10% as part of the Industrial Internet push) – run the businesses underneath. The primary differentiation between EMC2 and EMC II is that EMC2 also includes ownership in the other businesses. RSA is a division of EMC, it is listed separately because it has a strong stand-alone brand and that creates a perception of some separation from the parent company, since security topics can sometimes be a bit messy.

Choices and Openness

When asked about why the federation model is needed and what differentiates the companies from competitors, the answer is “choice”. While VMware has the leading hypervisor and EMC will, of course, offer the best infrastructure for VMware, EMC must also be able to partner and develop solutions with Microsoft, Citrix and others. While Pivotal solutions can run on any cloud (including IaaS leader AWS) or hypervisor, they will get the highest performance with VMware and be the most hardened when the full solution stays inside of the federation. In addition to partnering outside the federation, there should be times when the companies will compete directly; for example, VMware Virtual SAN (VSAN) is competitive with any storage array offering, which is the majority of EMC’s business. Wikibon is bullish on the Server SANmarket that includes VSAN, EMC ScaleIO and a number of non-federation players.

Another threat to the federation is the growth of open source solutions. During a Q&A with the Federation CEOs (photo above), I asked how open source fit into the overall strategy. I premised the question with the comment that Pivotal embraces open source, VMware prefers open interfaces (see interview with VMware/Nicira’s Martin Casado about the shift from open source to open standards) and EMC uses standards. In response, Pat Gelsiner and David Goulden confirmed that they would not be making any significant changes to business practices; so open source would not become a major focus. Paul Maritz stated that customers want standardized solutions and for emerging solutions in the PaaS and big data space, this required the use of open source, since industry standards would take too long to develop. This matches Wikibon survey data showing that while users don’t want to be “locked in”, only about 15% choose a strategy based on open source. At the recent OpenStack Summit, while VMware had a booth and EMC had attendees, their participation did not reach the level of the strong leadership roles of IBM, HP and Red Hat. While OpenStack and other open source projects could be a threat down the road, there is much greater competition today from Amazon AWS and Microsoft Azure/Hyper-V.

The Business Imperative

In recent years, agility and creating new business value is at the top of the list for CIOs. It has been said that while in the past solutions were compared against how they could be faster, better and/or cheaper, today faster alone can make up for the other factors.

The federation has an audacious goal – it is looking to help companies create new value and revenue streams while also helping to control or cut costs. The top line IT is to deliver speed and the bottom line is managing the cost of that speed. Pivotal’s PaaS and Big Data solutions are targeted heavily at helping companies accelerate the pace of innovation. VMware’s core virtualization offerings may have helped with efficiency and the cost of infrastructure, but it was the speed of delivery that made the offering a game-changer; the company must extend this power to the full SDDC including storage, networking and orchestration. EMC looks to deliver the best infrastructure for fully virtualized environments as well as bring simplicity and agility to storage with a broad portfolio of flash offerings and ViPR/ECS, which provides orchestration and even a path to commodity hardware.

One of the most appealing things about solutions from the federation will be that they should reduce the amount of time and effort to design, build, test and integrate the pieces versus buying pieces of the stack together. This will be especially compelling to users who buy VMware enterprise licenses and have an installed base of EMC gear. The real battlefront will be how fast users migrate from traditional to more modern scale-out “cloud/mobile” applications. While Pivotal is helping to built those environments, so are Amazon, Google and others who will look to alternatives to VMware and EMC to help drive new economics.

Action Item: The EMC federation plays it both ways – if enterprise IT is slow to make changes, it can continue to sell the infrastructure, software and services that make it a market leader, and if IT wants to accelerate the rate of change, the EVP message will get consideration since it is from a trusted source. The increased pace of change in IT means that users should consider solutions that shorten the time between refresh cycles and that are flexible and extensible. Applications are the drivers of all infrastructure decisions; users should justify the application portfolio and understand the best fit between SaaS, public and hybrid cloud.